What I’ve been investing in is a monthly series covering what investments I’ve made during the month, and any investing related news that I’ve found interesting. Hopefully you’ve been able to enjoy some nice weather this month! It’s summer and the school holidays, which means a quiet start to the year for investing, but there’s still plenty of great content in this article.

The below is not financial advice, nor a recommendation to invest in the following. Please do your own research before making any investment decisions.

What I’ve been investing in

InvestNow

In my December 2019 update I spoke about consolidating and simplifying my InvestNow portfolio, cutting down from 9 funds to 5. This month I reduced the number of funds I own even further, from 5 to just 2! I am now left with one Global Shares Index Fund, and one NZ Shares Index Fund, currently in the form of:

- AMP Capital All Country Shares Index Fund (~85%)

- AMP Capital NZ Shares Index Fund (~15%)

I am definitely practising what I preach, after writing the article “More funds = less diversification? Are you investing in too many funds?” It has certainly been a messy journey in getting my fund portfolio into this simplified state, constantly adding and culling funds throughout the last year or so. But I’ll consider this as part of the learning process in becoming a better investor.

Sharesies

To provide full transparency, here’s some details about my investments in Sharesies. I have a Sharesies referral link (like the one below) placed throughout this website. The link gives me $5 for every person signing up to Sharesies, and until the end of 7 February 2020, the person signing up gets a bonus $10 in their Sharesies account.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

The money I get from these sign ups can’t be withdrawn straight away, and must be used to make an investment. So following this month’s theme of keeping your investments simple, I invested it all into Smartshares’ Total World ETF. Thank you to all who have used the link – your support for the site is much appreciated, and I will put this money aside to pay for the running costs of this site.

Investing news

Metlifecare takeover

Late last month it was announced that aged care operator Metlifecare was the subject of a takeover bid, with Swedish fund manager EQT offering to buy the whole company for $7 per share. A lot of people were curious about what would happen to their shares, and whether it is a good deal. So here’s the details:

What will happen? The takeover bid has not yet been finalised, and is subject to Overseas Investment Office approval, High Court approval, and a vote by exiting shareholders in April. If the deal is finalised, the company will be delisted from the NZX, and all Metlifecare shareholders will be given $7 cash for every share they own. EQT will then become the new shareholders of the company.

Is it a good deal? Given the share price of Metlifecare was around $6.30 when the deal was announced, many shareholders aren in line for a good capital gain, especially those who bought the shares at $5 and below. But there could be a couple of reasons to see the deal as negative. You may feel that the shares are worth a lot more than $7 per share and disappointed to be selling out at that price. You may also be disappointed that you have to exit your investment earlier than anticipated and now face the prospect of finding a new investment for your cash.

Dealing with takeovers are a normal part of being a shareholder, and the Metlifecare bid follows other recent takeovers of NZX listed companies such as Trade Me, Tegel, and Trilogy.

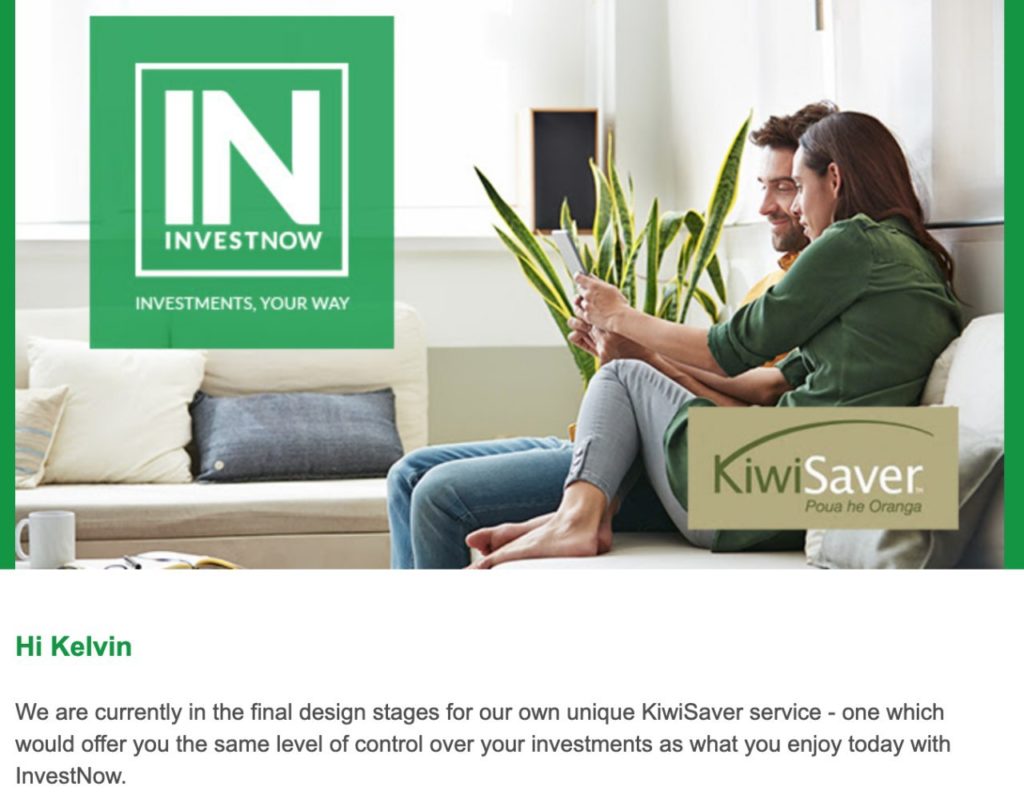

Progress on InvestNow KiwiSaver

After being briefly mentioned in my October 2019 update, InvestNow has confirmed that they are in the final stages in designing their own KiwiSaver scheme. This could be an excellent option for investors looking for more flexibility in where their KiwiSaver money is invested, adding to the existing DIY type schemes like Craigs, SuperLife, and to some extent Kōura.

However, it appears that they will only offer 25-30 funds through their KiwiSaver scheme (according to interest.co.nz), a small fraction of the 120 or so funds they have on the platform. The final details of InvestNow’s offering is something to look forward to in the next few months.

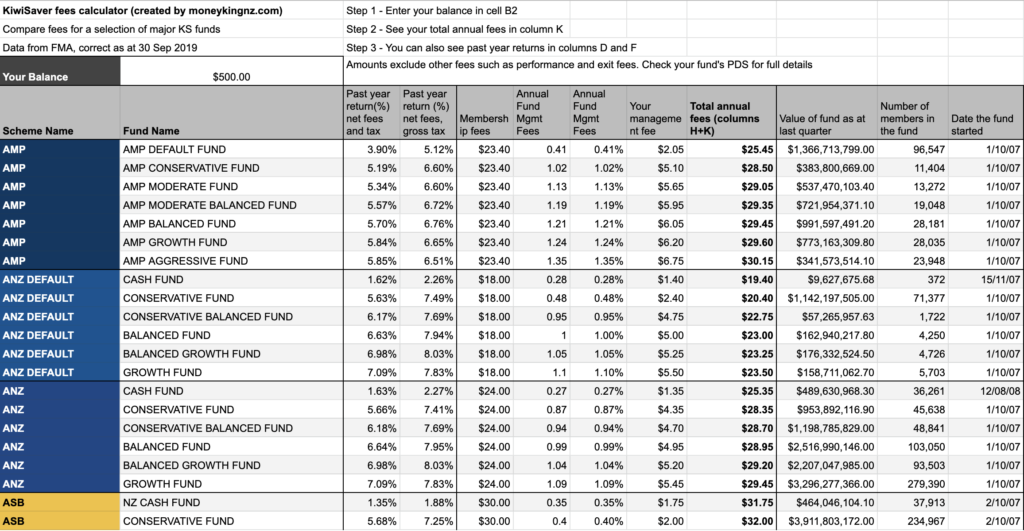

KiwiSaver fees

Recently there has been a little confusion in the investing community surrounding KiwiSaver fees, so here’s a friendly reminder about the fees you get charged:

You can compare the fees for your own KiwiSaver balance across approximately 90 different funds using this KiwiSaver fees calculator (must have a Google account to access).

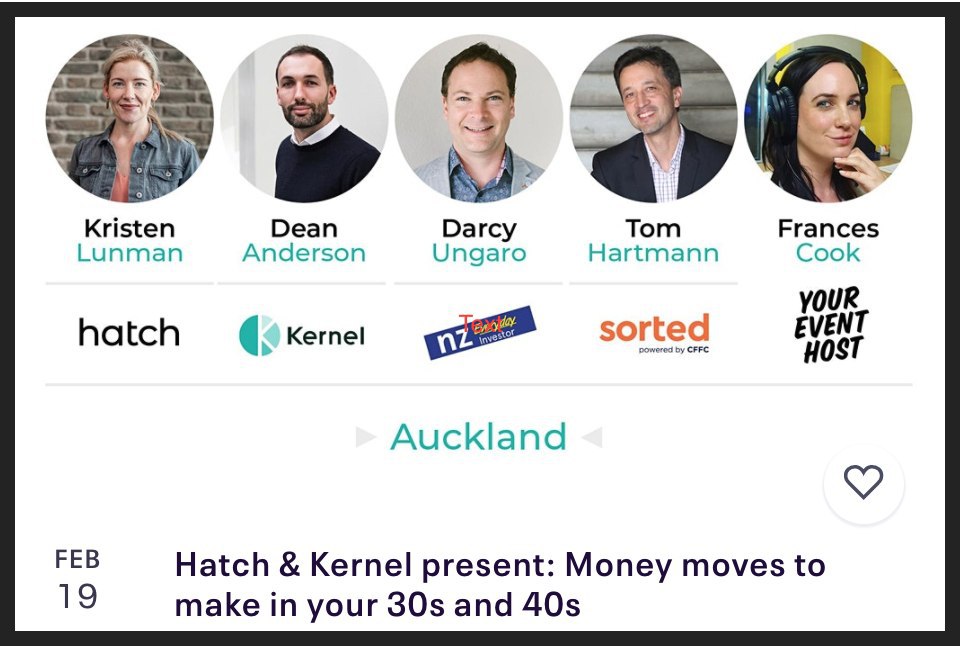

Events to look out for

Hatch and Kernel are hosting two events next month, about managing your finances in your 30s and 40s:

- SOLD OUT, WAITLIST ONLY – Auckland (Parnell) – 19 February, 6pm – 8pm

- Wellington (Wellington CBD) – 27 February, 6pm – 8pm

All four panelists and host are legends in the NZ investing and personal finance space, and there will be drinks and pizza on offer, so the event is well worth checking out! If you can’t get a ticket or make it, look out for a live stream on social media, or watch out for future events from Hatch and Kernel.

Money King NZ news

It has been a super busy month for the site, with visitor numbers almost tripling compared to previous months, and follower/subscriber numbers increasing from around 580 to over 820! Regular visitors may have also noticed that some pages on the site (like the homepage) have a slightly different look – this change was made to improve the performance of the site.

January 2020’s articles:

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

– 2020 Recession? How to prepare your investment portfolio

– Beyond the top 10 – How to see everything your fund is invested in

– More funds = less diversification? Are you investing in too many funds?

This month Money King NZ was featured in:

MoneyHub – Named as a “Top New Zealand Personal Finance Expert” in their article Top 10 New Zealand Personal Finance Experts. What an honour to be featured alongside the likes of The Happy Saver and Mary Holm, although I don’t think I am of the same calibre as these two!

Kernel – My article Funds 101 – What’s the difference between an Index Fund, ETF, and more? was republished on their blog.

Last month’s What I’ve been investing in article:

– What I’ve been investing in – December 2019

Thanks for all your support!

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.