Following the Vault International Bitcoin Fund, the Squirrel Monthly Income Fund is the second fund issued by IIS in recent months that invests in alternative assets. But rather than investing in crypto, this fund invests in peer-to-peer loans, which gives investors exposure to residential property lending and delivers a monthly distribution. This review covers the ins and outs of the fund, including fees, tax treatment, and how it compares to direct investment into peer-to-peer lending. How might this fund fit into your portfolio?

This article covers:

1. What’s on offer?

2. How does the fund compare to direct P2P Lending?

1. What’s on offer

Background

The Squirrel Monthly Income Fund is managed by Squirrel, a mortgage broker and provider of a peer-to-peer (P2P) lending platform which allows everyday investors to lend money to other individuals and businesses. If you want to learn more about the Squirrel P2P lending platform, you can do so through the video or articles below:

Further reading:

– Investing with Squirrel – how it works (YouTube)

– 5 things to know about investing in Peer to Peer Lending

– Peer to Peer Lending review – Squirrel

What the fund invests in

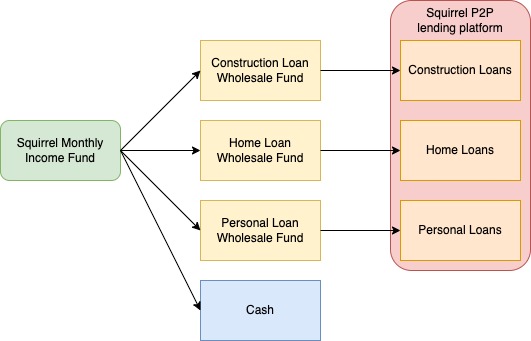

The fund invests into the three classes of loans offered on the Squirrel P2P lending platform:

- Constructions loans – Involves lending to people to buy land and/or build residential property, for a term of up to 2 years.

- Home loans – Involves lending to people buying an owner-occupied or investment residential property, for a term of up to 7 years.

- Personal loans – Involves general lending for things like funding renovations, or for a house deposit under Squirrel’s Launchpad product, for a term of up to 7 years.

The bulk of the fund’s investment will be towards Construction loans, with a smaller allocation towards Home loans, and a target allocation of 3% towards cash (to maintain liquidity). There’s unlikely to be any immediate investment into Personal loans as there’s currently a shortage of these loans on the Squirrel P2P lending platform.

The fund doesn’t invest in these P2P loans directly. Instead the fund invests in Squirrel’s three wholesale funds (one for each loan class), which subsequently invest into the individual loans on Squirrel’s P2P platform.

How you can make money

By investing in the fund you can earn interest from the underlying loans. The potential returns are higher than bank deposits, given P2P lending involves lending your money directly to borrowers such as homeowners and home builders, an industry currently dominated by banks who take the lion’s share of the profits.

Example of P2P lending returns

A 2 year bank term deposit is currently paying around 2.30-2.50%, while the rates of interest the underlying P2P loans are currently paying are:

Construction loans – 5.00% floating rate.

Home loans – 4.00% floating rate.

Personal loans – 6.00%-7.50% fixed rate.

This concept has already existed in a managed fund offering for a couple of years. Simplicity currently lends out part of their funds’ assets directly to borrowers as home loans to earn more interest compared to bank deposits or bonds. However, Squirrel’s fund is unique in having almost the entire fund committed towards lending to the NZ residential property market, with an aim to shift some of that market (and its profits) away from banks and towards retail investors.

Target returns

Overall with the blend of loans it invests in, the fund targets an annual return of 4% above the OCR (after all fees, but before tax). So with the OCR at 0.75% at the time of writing, the fund is aiming to deliver a return of 4.75% p.a. This return will come entirely from interest – the underlying P2P loans have no potential for capital growth.

Where you can invest

The Squirrel Monthly Income Fund can be accessed via fund platform InvestNow (but is not available through the InvestNow KiwiSaver scheme).

Further Reading:

– InvestNow review – The most efficient way to invest?

2. How does the fund compare to direct P2P lending?

The Squirrel Monthly Income Fund provides another channel for people to invest in Squirrel’s P2P loans. So how does the fund compare to direct P2P lending through Squirrel’s platform?

Minimum investment

Direct P2P lending – The Squirrel platform’s minimum order size is $500.

Squirrel Monthly Income Fund – Like with InvestNow’s other funds, the minimum investment is $250, or $50 if you set up a regular investment plan.

Risk

Direct P2P lending – The main risk of investing in P2P loans is credit risk – the potential for the borrower to default and not pay you back. There’s a few mechanisms the Squirrel platform uses to mitigate this risk:

- Reserve fund – A pool of money which can be used to reimburse investors if a loan misses repayments or defaults. The reserve fund system has worked well so far for Personal Loans, with no investor money lost to date. The system is yet to be tested for Home and Construction loans (as there haven’t been any defaults on these loan classes so far), but would only be only be called upon if the security for the loan wasn’t enough.

- Security – Construction and Home loans are secured with a first mortgage over the property or land. With Home and Construction Loans there’s a maximum Loan-to-Value ratio (LVR) of 80%, or less if the property being built hasn’t yet been sold, or if the loan is only being used for the purchase of land.

- Maximum loan size – The maximum Home and Construction loan size is $2 million. For Construction loans, this would usually at most support the construction of a single house or 2-3 townhouses. Squirrel deliberately doesn’t lend to medium or large scale developments, given the higher risks.

- Creditworthiness of borrowers – The ruthless lending of money to low quality borrowers (and subsequent securitisation of those loans) was a contributor to the Global Financial Crisis in the late 2000s. There may be some concern Squirrel’s P2P loans and fund may mirror the GFC situation, however Squirrel aims to only issue loans to borrowers assessed to be creditworthy.

Personal loans also carry interest rate risk. Their interest rates are fixed throughout the term of the loan, so any wider interest rate increases could result in these loans providing a less attractive return relative to other investments.

Squirrel Monthly Income Fund – You’re exposed to the same risks as above by investing through the fund. The fund helps mitigate risk by providing diversification across loan classes and individual loans, but this arguably isn’t required on the Squirrel platform with their safety mechanisms.

The fund’s heavy weighting towards the floating rate Construction loans will also help protect against interest rate risk, given the floating rates will rise and fall alongside broader bank mortgage rates. However, residential housing developers aren’t perceived to be the safest borrowers right now, given challenging factors like materials and labour shortages, and interest rate rises. We asked Squirrel what they thought of these risks:

We assess every construction loan deal to ensure we believe it is sound. This involves understanding the financial position of the person/company we are lending to, and the quality of the security. We assess their proposed construction plans, and only advance funds as value as created. We ensure we get evidence of the builds progress before we advance any new funds through council sign-offs, photos, and may include site visits. There is always risk, however we believe we perform appropriate due diligence on each project.

Dave Tyrer, COO, Squirrel

Another point to note is that in the future, the fund may invest directly into Construction and Home loans (instead of picking up loans from the Squirrel platform). By going direct the fund would lose the protection of the reserve fund (instead it would rely on the security under each loan for protection), but this would increase returns as the fund wouldn’t have to contribute to the reserve fund.

Overall, P2P loans are riskier than bank deposits and bond funds, given the direct exposure to the credit risk of borrowers. The fund has a minimum suggested investment timeframe of 2 years.

Returns

Direct P2P lending – Direct P2P Lending allows you to build a customised portfolio from whatever loan classes you wish, according to your risk tolerance. Riskier loan classes have higher potential returns:

- Construction Loans – Moderate risk, providing a 5.25% floating return.

- Home Loans – Lower risk, providing a lower 4.25% floating return.

- Personal Loans – Higher risk, providing a higher 6.00%-7.50% fixed return.

Squirrel Monthly Income Fund – With the fund you’re stuck with the blend of loan classes chosen by the fund manager, which is primarily Construction loans. There’s no ability to achieve higher potential returns by weighting your exposure to loans towards the Personal loan class for example.

Fees

Direct P2P lending – On the Squirrel platform, a portion of each interest payment made by borrowers goes to Squirrel as a “service margin” – this is effectively a fee as it reduces the interest earned by an investor. This currently ranges from 0.50% to 2.95%. The returns shown on the Squirrel platform are inclusive of the service margin – for example, the current Construction loan interest rate of 5% reflects the amount of interest investors earn after the service margin has been applied.

Squirrel Monthly Income Fund – The fund has a management fee of 0.65% p.a. In addition the underlying loans of the fund are also affected by the service margin, which is expected to be an average of 1.05%.

Ease of investment

Direct P2P lending – This requires you to sign up to a new platform and learn a new asset class – and Squirrel isn’t the easiest P2P Lending platform to wrap your head around. Once you’re in the platform you’ll have to place investment orders for loans, then wait for your money to be matched to a loan (though Squirrel has an auto-invest function which can streamline this). It can be quite a hands-on investment.

Squirrel Monthly Income Fund – This works the same way as investing in any other managed fund product. You can simply buy units in the fund and set-and-forget, with the fund manager taking care of investing your money into loans for you. And if you’re already an InvestNow customer, you don’t even need to sign up to a new investment platform to get access to this fund.

Payment of interest

Direct P2P lending – Interest on each loan you invest in is paid on a monthly basis. This gets paid out to your Squirrel account, where it can then be reinvested or withdrawn to your bank account.

Squirrel Monthly Income Fund – The fund aims to pay out distributions on a monthly basis, on about the 10th business day of each month. By default InvestNow automatically reinvests your distributions into buying more units of the fund, but you can choose to receive them as cash.

Liquidity

Direct P2P lending – The Squirrel platform has a secondary market where you can sell your loans to other investors if you need to get your money out before the term of your loan ends. However, there’s a risk that they’ll be no investors on the platform willing to buy your loans off you (though this hasn’t been an issue so far).

Squirrel Monthly Income Fund – You can sell your units at any time via InvestNow by giving 30 days notice. This is significantly longer than most other InvestNow fund offerings, which typically take around 2 business days to get your money out.

Tax

Direct P2P lending – The interest you earn is taxed at your marginal tax rate which can be up to 39%.

Squirrel Monthly Income Fund – You’re taxed at your Prescribed Investor Rate (PIR) which has a maximum rate of 28%. This is because the fund is structured as a Portfolio Investment Entity (PIE), just like your KiwiSaver fund and most other funds on InvestNow. This tax is payable after the end of the tax year (31 March) or whenever you sell units in the fund.

The maximum tax rate of 28% could be beneficial for those on a higher marginal tax rate (e.g. 33% or 39%). However, this tax benefit won’t always be enough to offset the 0.65% p.a. fund management fee. Our basic calculations suggest the OCR would need to be at least 4.50% for 33% taxpayers, or at least 0.75% for 39% taxpayers for the tax benefit to offset the management fee.

Conclusion

Squirrel’s Monthly Income Fund is quite similar in a way to the Vault International Bitcoin Fund. They’re both innovate products making alternative asset classes more accessible, and providing more options to investors. The fund conveniently packages P2P loans into a PIE fund, improving tax efficiency and ease of investment, and helping everyday investors get exposure to a market dominated by the banks. The downsides of this structure are that investors have to pay a management fee of 0.65%, lose control over what loan classes they’re invested into, and require 30 days notice to get their money out.

Overall, the fund could supplement income assets in an investment portfolio, providing higher yields than cash and bond investments – though comes with higher risk, so definitely won’t suit everyone. It’s available on InvestNow making it easy to slot into many portfolios, but those willing to be more hands-on with their investments might be able to achieve better results with direct investment into P2P loans. In addition, the fund isn’t a substitute for growth assets – despite the fairly attractive interest rates and regular distributions, there’s no potential for capital growth, and longer-term investors may be better off sticking with shares.

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.