Sharesies are making big changes to their fee structure starting from 29 April 2021, saying goodbye to their subscription fees, while welcoming transaction fees on NZX listed ETFs. This article breaks down these changes and looks at how they might impact you.

This article relates to Sharesies’ April 2021 fee changes. A new article breaking down their January 2023 fee changes can be found here!

Check out our full Sharesies review:

– Sharesies review – Still a good investment platform in late 2021?

1. Removing the subscription fee

Current subscription fees (prior to 29 April 2021)

Sharesies charges a subscription fee if you have an account balance over $50. This fee is deducted from your Sharesies wallet monthly, or annually if you’ve opted in to the annual plan. The subscription fee structure can be seen in the image below:

Kids accounts (for those under 18) do not pay any subscription fees.

New subscription fees (from 29 April 2021)

Sharesies will no longer charge any subscription fees. Their primary way of making money will be from transaction fees which customers pay whenever they buy or sell an investment. It appears Sharesies will refund investors who have recently paid their subscription fee, but it’s unclear who specifically will qualify for this.

If you’re paying $10 per month to get the NZX market depth feed, this fee will remain in place.

What’s the impact?

The subscription fee made Sharesies incredibly expensive for investors with low balances. For example, if you had $250 in your account, the annualised subscription fee would equate to 7.2% of your portfolio value – that’s enough to wipe out any profits you could make in an average year.

| Account value | Annualised fee as a % of your account value |

| $50 | 36% |

| $250 | 7.2% |

| $1,000 | 1.8% |

| $1,500 | 1.2% |

Investors with low balances will find the removal of the subscription fee great news, as they will no longer be penalised for investing a small amount. Now they can build up a portfolio at whatever pace they want without having to be concerned about their balance being eroded away by monthly fees.

all my profits go towards that stupid subscription fee… glad it’s about to be gone

Facebook commenter

Investors with higher balances will also enjoy the fact that they can save up to $36 per year in subscription fees, although the impact on their portfolios will not be as substantial.

Kids accounts won’t be impacted at all, as they already aren’t being charged subscription fees.

2. Adding transaction fees on NZX listed ETFs

Current NZX listed ETF transaction fees (prior to 29 April 2021)

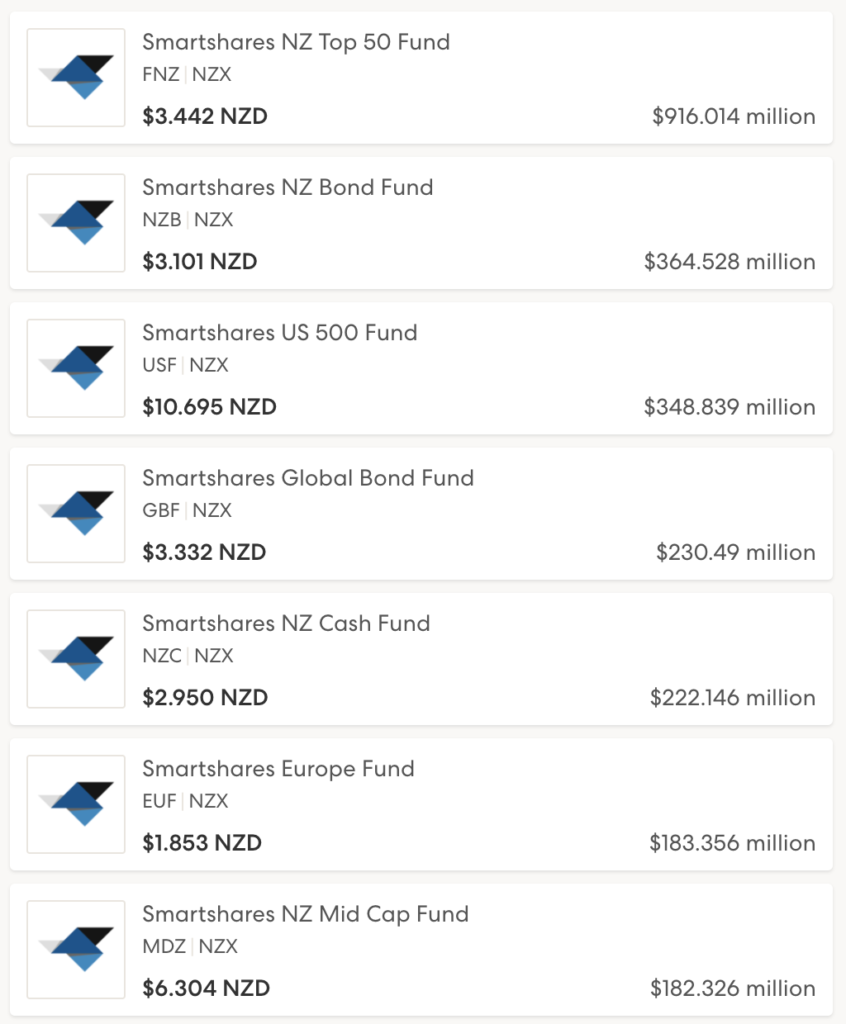

Currently there are no transaction fees for buying or selling NZX listed ETFs. This represents 35 Smartshares ETFs and the Salt Carbon Fund.

New NZX listed ETF transaction fees (from 29 April 2021)

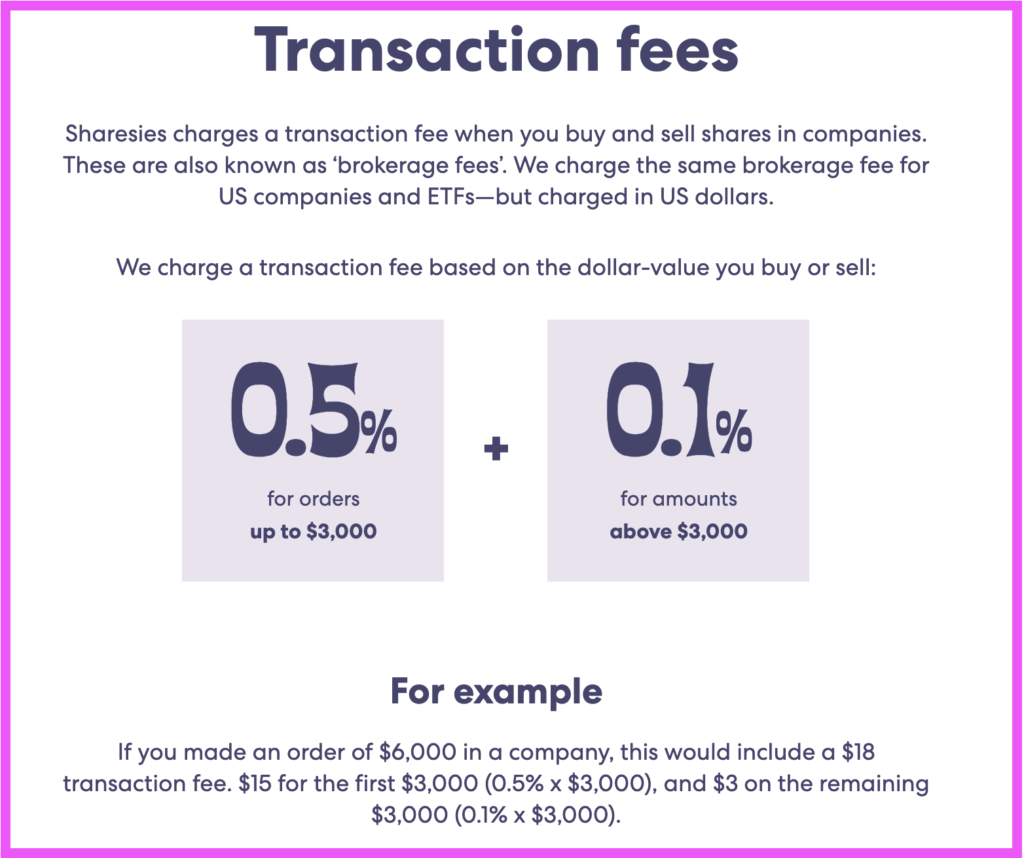

The standard Sharesies transaction fees will apply to NZX listed ETFs from 29 April. That is:

- 0.5% on orders up to $3,000

- 0.1% on any amounts above $3,000

Transaction fees for all other products are not changing. Transaction fees for individual shares on the NZX, and well as for shares and ETFs on the ASX and US markets will remain the same. The 0.4% fee to exchange currency between NZD, AUD, and USD will also remain the same.

What’s the impact?

If you don’t buy or sell NZX listed ETFs (like the range of Smartshares ETFs), this change won’t impact you, as fees for other investments are not changing.

If you buy and sell small amounts in NZX listed ETFs, this change should not make you worse off, as the removal of subscription fees will offset the transaction fees you’ll now have to pay on the ETFs.

However, if you buy and sell larger amounts in NZX listed ETFs you’ll find that you’re worse off as the new transaction fee is greater than the removed subscription fee. In general you’ll pay ~$5 in transaction fees for every $1,000 in NZX listed ETFs you buy or sell. Therefore anyone buying or selling more than ~$6,000 worth of Smartshares ETFs in a year (or ~$500 per month), will find that the new transaction fee costs them more than the existing $30 annual subscription fee.

Joy, the only reason I kept with them is gone. Gonna move my funds over somewhere else and hold onto my individual shares there.

Reddit commenter

Kids accounts are worse off no matter what, as there is no reduction in their other fees to offset the new NZX listed ETF transaction fee.

What’s the alternative?

If you’re negatively affected by the change, InvestNow is the obvious candidate as a direct replacement for your Smartshares ETF investing (they do not offer the Salt Carbon Fund). InvestNow has long been cheaper than Sharesies even before the fee changes, offering the full range of Smartshares ETFs (except for TWH and NGB) with no transaction fee and without any account fees.

However, InvestNow does not offer individual NZX shares, nor do they offer investment into the US and Australian markets. So you would have to keep using Sharesies for any NZX, ASX, and US investments.

There are just a few differences between Sharesies and InvestNow on how they handle Smartshares ETFs to be aware of:

- Minimum investment – The minimum investment on InvestNow is $250 per ETF for a one-off investment, or $50 per ETF on a regular investment plan. This is significantly higher than the $0.01 minimum on Sharesies, who achieve such a low minimum by offering fractional units (the ability to own a fraction of a unit in an ETF).

- Dividend reinvestment – InvestNow allows investors to automatically reinvest dividends into buying more units of the ETF. With Sharesies, dividends are paid into your wallet and must be reinvested manually (and in doing so, you’ll incur the new transaction fee).

- Execution – Sharesies executes their Smartshares ETF orders on the market whenever the NZX is open, enabling investors to set a limit price for their orders. InvestNow executes their Smartshares orders only once every weekday shortly after Midday. This difference is a minor one and should not matter for the long term investor.

Unfortunately there is no easy way to transfer investments over from one platform to another. You would have to sell your Smartshares ETFs on Sharesies (ideally before the 29th to avoid the transaction fee), then buy the same investments over on InvestNow. In doing so you may lose a little bit of money due to the spread (the difference between the buy price and the sell price of your ETFs) – this essentially means you’ll have to buy back in to your ETFs at a slightly higher price than what you sold them for.

Conclusion

The fee changes Sharesies that is making are both positive and negative, but it appears that most of their investors will end up better off with the removal of subscription fees, and that the change will make Sharesies more accessible to newer investors. Sharesies claim that over 96% of their customers won’t be negatively affected.

Over 96% of our investors will be better off – and it is a significant reduction in revenue for our company from the changes. There is a small group who regularly invest more than $500 per month into NZ based ETFs that might be a bit worse off fees wise, but on a percentage basis very small as compared to the benefits for those positively impacted

Leighton Roberts – Sharesies co-founder

The Smartshares ETFs are popular investment options and those who use these ETFs as a substantial part of their portfolios may find the change a compelling reason to look into alternative options. If this is the case for you, take your time to carefully consider your options, as knee-jerk reactions are not helpful in the world of investing – whether it be reacting to market volatility or reacting to fee changes.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.