As a motorist you might be familiar with going through the annual ritual of maintaining your car by getting a Warrant of Fitness (WOF) and having it serviced. How about your investment portfolio? While good, simple portfolios won’t require much ongoing maintenance, they’re still worth looking after – after all it will likely become one of the most valuable assets you’ll ever own. So what might an annual WOF and service for your investments look like? There’s no standard checklist or procedure for ongoing care for your portfolio, but here’s how we’d approach it.

1. Review your investment goals and personal circumstances

Everyone has a different reason for investing, and hopefully you have some clear goals for investing too. This might be investing for a house deposit, for retirement, to achieve financial independence, or for a child’s education.

Investment goals can change

Have your personal circumstances changed? These rarely remain static, and things like a change in career, changes in income, new priorities in life, new family members, or perhaps no longer wanting to own property can result in a change to your investment goals. A change in goals may change the way you need to invest, which we’ll explore further in section 2 of this article.

Further Reading:

– How to invest for kids in New Zealand

– Buying a house – an overrated way to build wealth?

Check your progress

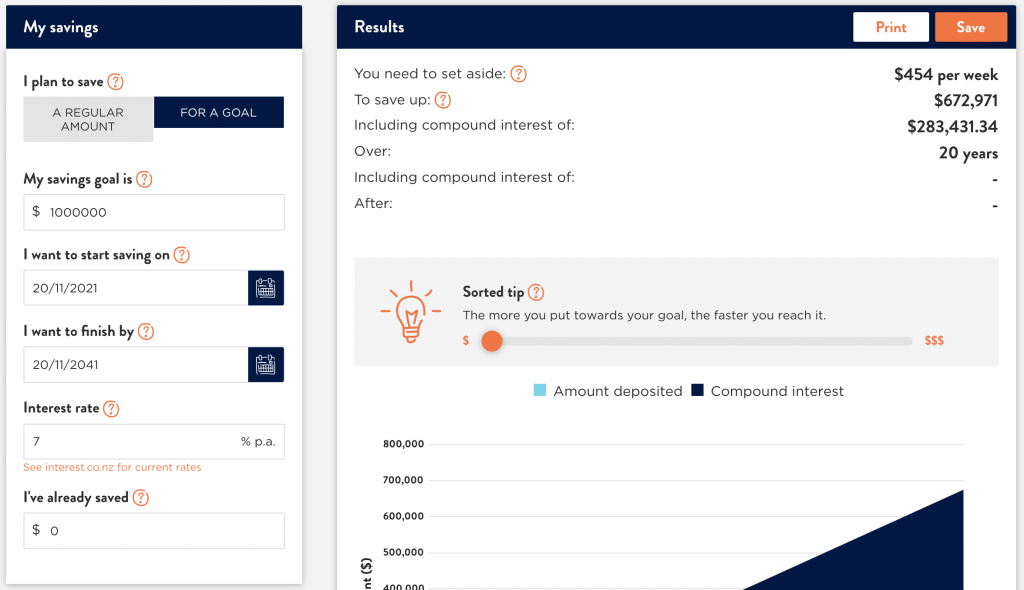

Are you on track to reaching your investment goals? For larger long-term goals, you could break them down into smaller yearly, monthly, or weekly goals to make them easier to track. For example, if you wanted to achieve a $1,000,000 investment portfolio in 20 years, you could use the Sorted Savings Calculator to calculate that you’d need to invest $454 per week or $23,608 per year to reach that goal (assuming your investments earned a 7% return each year).

If you’ve met your investing goals for the year, congratulations! And if you’ve exceeded them, could you keep your foot on the accelerator to reach your goals sooner? Or could you afford to slow down and invest in less risky assets? Your Money Blueprint has a good article exploring the concept of investing for enough, instead of taking on more risk than you need to.

I know I don’t need sky high returns to achieve my goals. So I don’t need to chase any highly volatile hot stocks (ahem Tesla), funds (ahem ARK) or assets (ahem cryptocurrency and NFT’s). Sure, they could make the journey faster, but they could also make it much slower. I don’t need to take the risk to find out.

Your Money Blueprint

If you haven’t met your goals for the year, that’s ok – the path to achieving your goals won’t always be a smooth one. Are there any changes you could make to your investment strategy to help you get back on track, such as moving spare cash off the sidelines and into shares, increasing your contributions, or are there any investing mistakes you can learn from?

Lastly, you don’t have to change your investing behaviours to get back on track with your goals, but instead you could move the goalposts. For example, if you’re not on track for a goal to buy a house, could you adjust your goal to buy a house later or buy a smaller property?

2. Review your asset allocation

Asset allocation refers to how you divide the money in your portfolio up into different types of assets (like shares and bonds), and is a main driver of your portfolio’s risk and returns.

Alignment to your goals and risk tolerance

Your asset allocation should always align with your investment goals. This isn’t just about your age, income, and the amount of money you need – but rather the primary driver of asset allocation is the amount of time you have to reach your goals:

- Investing for the short-term (e.g. investing for a house deposit in a few years time) – An allocation towards more income assets like bank deposits and bonds may be best, given their lower risk and ability to shield your money away from the volatility of the sharemarkets.

- Investing for the long-term (e.g. investing for retirement in a few decades) – An allocation towards more growth assets like shares may be best, given a long investment timeframe allows you to ride out any short-term volatility in the market and take advantage of the higher potential returns.

And if you have multiple goals with different timeframes, you could have separate buckets for your investments – for example one bucket invested in bank deposits for short-term goals like a wedding, and another bucket holding shares for long-term goals like retirement.

Further Reading:

– What’s the best short-term investment?

Your risk tolerance is also an important consideration. While asset classes like shares and crypto have greater potential long-term returns, they’re also highly volatile. So if you’re risk adverse, it might not be worth loading your portfolio up with shares if their volatility will hurt your mental health or keep you up at night.

So does your current portfolio align with the above factors like investment timeframe and risk tolerance? Does it take into account any changes to your goals or personal circumstances?

Realign and Rebalance

If your asset allocation doesn’t match your goals or risk tolerance, consider realigning it. For example, if you’re a short-term investor you might sell off your shares and move that money into a term deposit, and vice versa if you’re a long-term investor. This will bring your investments in line with your goals and ensure you’re not taking on too much or too little risk.

Even if you don’t need to realign your portfolio, you still might need to rebalance it. Over time different assets will grow at different rates, resulting in them shifting away from your target asset allocations. For example, if your portfolio has a target allocation of 80% towards shares and 20% towards bonds, and your shares grow faster than your bonds, your actual asset allocation could become overweight in shares and underweight in bonds. Rebalancing would be needed to bring your actual asset allocation back to 80% shares and 20% bonds. This could be done by:

- Selling off some of your overweight assets (e.g. shares), and redistributing the money into buying underweight assets (e.g. bonds).

- Focussing your subsequent investment contributions on your underweight assets (e.g. bonds) until they match your target asset allocation. This strategy could save on fees as it doesn’t involve selling off any investments.

3. Check your individual assets

While the above steps relate to your portfolio as a whole, it’s worth reviewing your individual assets too.

Emergency fund

How’s your emergency fund? An emergency fund is a pool of easily accessible money that you can use to cover any unexpected expenses, without having to disturb the investments in your portfolio. For example, if you lose your job you can dip into your emergency fund to pay the mortgage without having to sell off your shares.

Common approaches to emergency funds are saving up a few months worth of expenses or a couple of months of income, though there’s no fixed rule as to how much money you should have in it. Regardless of how you structure your fund, you might want to consider topping it up, for example due to inflation or lifestyle changes that have increased your expenses.

Further Reading:

– The best bank accounts and credit cards for managing your everyday finances

KiwiSaver

Are you in the right type of KiwiSaver fund (especially if your goals have changed over the year, or if you’ve moved closer to your goals)? This will typically be a Growth fund for longer-term investing (such as using KiwiSaver for retirement), a Balanced fund for the medium-term, and a Conservative fund for shorter-term investing (such as using your KiwiSaver to buy a house in the next few years).

And are you on track for the maximum Government Contribution of $521.43 per year? This requires you to make $1,042.86 of employee or voluntary contributions each KiwiSaver year (which runs between 1 July and 30 June each year). If you’re short of that amount, you can always make voluntary contributions to make up that target. But even if you don’t contribute the entire $1,042.86, you’ll still get 50 cents of Government Contributions for every dollar you put in.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

Individual assets

Do each of your individual assets still have a purpose in your portfolio? We’re fans of keeping portfolios simple, and chances are you have excess assets you can consider selling off. For example, you may consider selling off a meme stock or coin that has run its course, a company you no longer believe in, or a fund that overlaps with your other funds and doesn’t add any further diversification. These can then be reinvested into your existing holdings or into new holdings to fill any gaps in your portfolio.

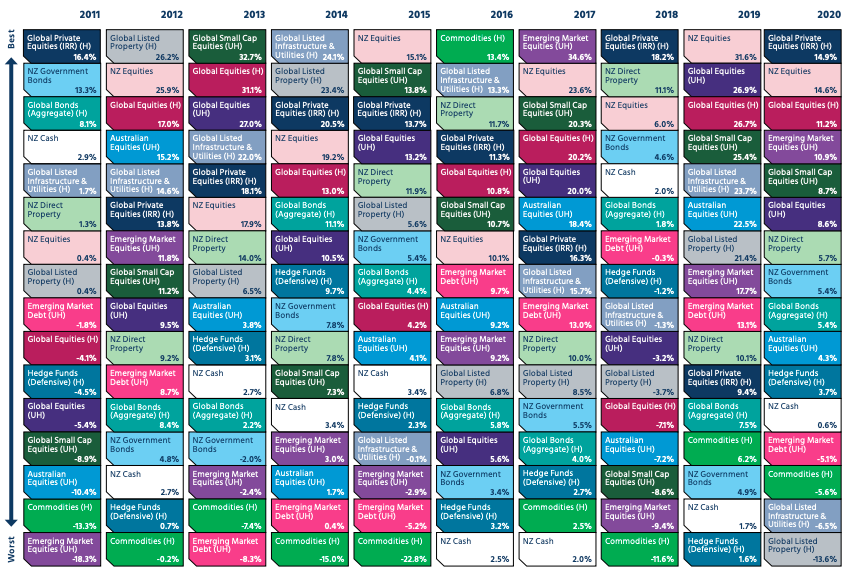

A poorly performing asset isn’t enough of a reason to get rid of it – investments aren’t guaranteed to do well every year, and may even lose money in some years. Nor is a well performing asset enough of a reason to buy more of it – there’s a good chance this year’s winners could be next year’s losers. Chasing winners and trends in an attempt to optimise your portfolio will likely just cost you brokerage fees rather than improve your returns.

Tax

While you generally won’t have to worry about tax until after the end of the tax year (31 March), for some investments it could be beneficial for you to consider tax upfront so you won’t have any nasty surprises when they’re due. For example, if you need to pay tax under the FIF regime, or on capital gains (as a trader), it might be worth setting some cash aside to meet these tax liabilities – investment platforms don’t typically take care of these types of taxes for you.

Further Reading:

– What taxes do you need to pay on your investments in New Zealand?

4. Check the systems supporting your investment

Investing isn’t just about picking which assets to invest in. There’s plenty of other aspects surrounding your investments and personal finances that are worth looking after.

Investment automation

Do you have your investments on auto-pilot, perhaps by using an investment platform’s auto-invest feature and/or automatic payments set up at your bank? If so, you may need to reset these to match any realignments to your asset allocation, or adjustments to your contribution levels.

Security

Are your investment accounts and logins secure? This might involve changing your passwords and enabling 2-factor authentication if available on your investment platform.

If you hold cryptocurrencies in your own wallet, do you know how to recover your wallet in the case it gets lost or stolen? And do you know the process of selling and withdrawing your crypto investments to your NZD bank account if needed?

Further Reading:

– Testing Sharesies’ security – Is your account vulnerable?

– How to buy Bitcoin in New Zealand (step-by-step guide)

Other financial products

Lastly, you may want to review your other financial products that support your general financial health. These could be:

- Bank accounts – Do you have the right bank accounts set up, and are you paying reasonable fees?

- Mortgages – Is your mortgage structured in a way that suits you?

- Lines of credit – Is there any debt like credit cards and Buy-Now, Pay-Later schemes that you can pay off or close off?

- Wills – Do you have a will to specify how your investments should be distributed when you pass away? If so, does it need to be updated to reflect any changes in your personal circumstances?

- Insurance – Do you have the right level of insurance cover?

MoneyHub is a comprehensive site covering a broad range of general personal finance topics, and is a good place to start researching the above.

Conclusion

We’re big fans of simple, set and forget investment portfolios. They don’t require much effort or tweaking once you have them in place – but just like a car, even the best investment portfolios need to be looked after. Ongoing maintenance doesn’t mean constantly switching funds or tweaking allocations in an attempt to squeeze out an extra percent in returns, but rather it’s to ensure:

- Your portfolio is aligned with your goals and personal circumstances.

- You know whether you’re on track to meet your goals.

- You have the right asset allocation, and are exposed to an appropriate level of potential returns and risk.

- Your individual assets have a purpose and are working as they should be.

- You have the right systems in place to support your investments and keep them safe.

These are all very important steps as your portfolio may become one of the most valuable assets you ever own – so make sure you give it the care it deserves.

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.