Six new KiwiSaver funds are launching on 1 December 2021, as part of big changes to KiwiSaver default providers. This article will take a look at how these changes might impact your KiwiSaver investments, what actions you may need to take, and whether these new funds worth your consideration. And if these changes have prompted you to jump into the market for a new KiwiSaver fund, what are some of our favourite options?

This article covers:

1. The new default funds

2. How do the changes impact you?

3. Our favourite alternative funds

1. The new default funds

Background

Any money you contribute into KiwiSaver is invested into a fund, and managed by a KiwiSaver provider (not by the government!). You’re free to choose the fund and provider you have your KiwiSaver with. However, if you don’t choose one at the time you sign up to KiwiSaver, you’ll get put into a randomly selected default fund with a default provider.

Default providers are chosen by the government through a tender process, and are reviewed every 7 years. The latest review concluded earlier this year, and as part of that review, changes to KiwiSaver default providers will take effect from 1 December 2021.

New default providers

The first change involves a few changes to the KiwiSaver provides who’ve been appointed as default providers:

- 4 providers retain their default status.

- 5 providers lose their default status, but remain as non-default KiwiSaver providers.

- 2 providers have been newly appointed as default providers.

These providers are:

| Old (prior to 1 Dec 2021) | New (from 1 Dec 2021) |

| BNZ | BNZ (retained) |

| Booster | Booster (retained) |

| Kiwi Wealth | Kiwi Wealth (retained) |

| Westpac | Westpac (retained) |

| AMP (not retained) | Simplicity (new) |

| ANZ (not retained) | SuperLife (new) |

| ASB (not retained) | |

| Fisher Funds (not retained) | |

| Mercer (not retained) |

New default funds

The second change involves each of the six newly appointed default providers introducing brand new default KiwiSaver funds. These funds all have the following key features, with an aim to improve investment outcomes for default investors:

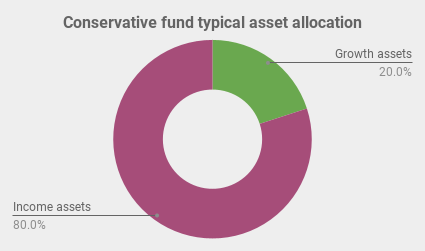

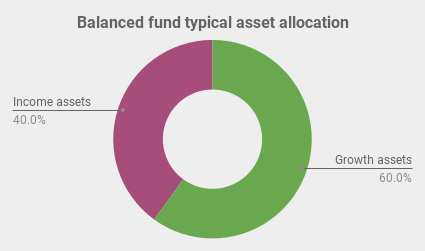

- Fund type – The new funds are all Balanced funds, which invest in approximately 60% growth assets (e.g. shares) and 40% income assets (e.g. bonds). This is a major change from the old default funds which were Conservative funds, investing in a higher proportion of income assets (typically up to 80%). This move is expected to deliver higher potential returns over the long-term.

- Fees – The funds have low percentage based management fees, and don’t charge any fixed membership fees.

- Exclusions – The funds exclude investment into companies producing fossil fuels or illegal weapons.

- Communications – The funds offer better engagement with their investors, providing guidance in situations such as when first signing up to KiwiSaver, during market volatility, and a year before an investor reaches retirement age.

- Regulation – The government and FMA tend to keep a closer eye on default funds to ensure they continue to meet the above requirements.

An 18-year-old earning $50,000 a year and contributing three percent of their income to KiwiSaver is estimated to have an extra $143,000 when they reach 65. They will also pay around $3,900 less in fees

Hon Dr David Clark, Commerce and Consumer Affairs Minister

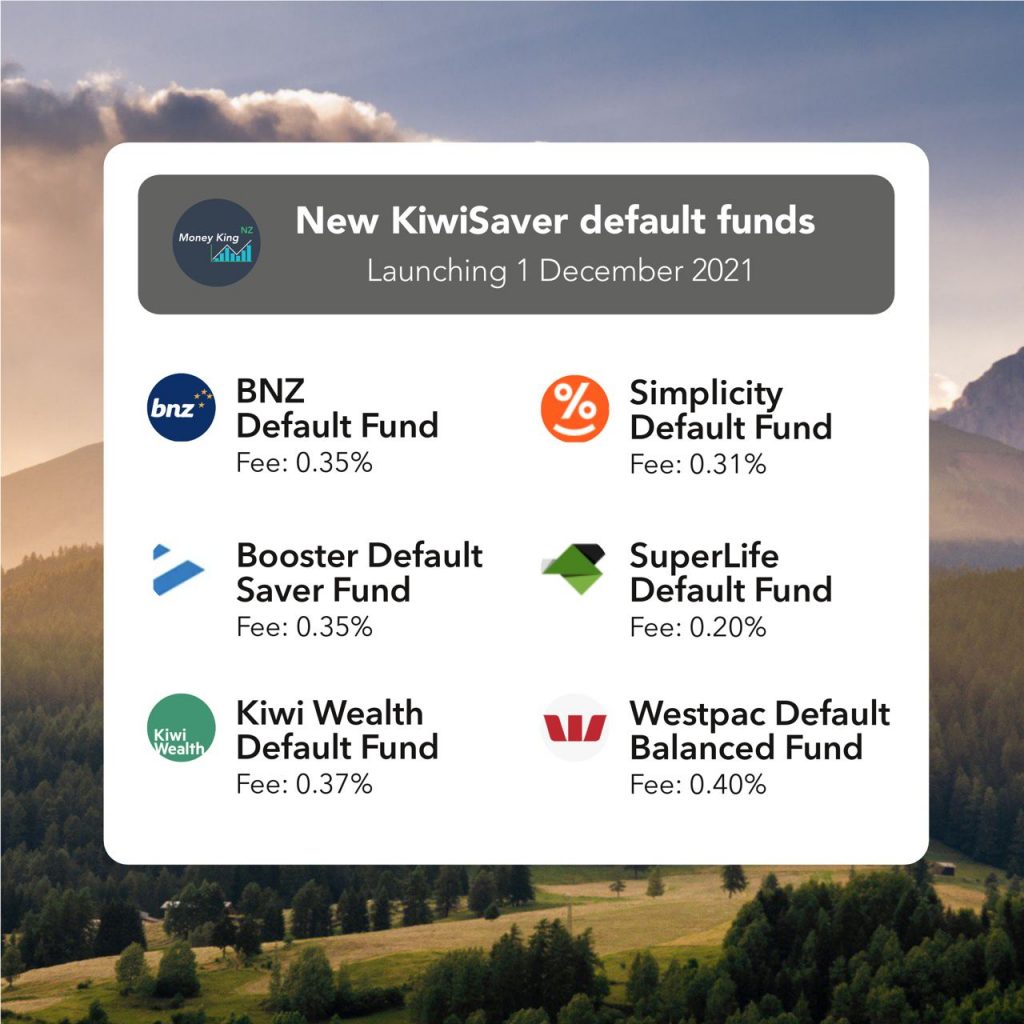

The new funds are (with management fees in brackets):

- BNZ Default Fund (0.35%)

- Booster Default Saver Fund (0.35%)

- Kiwi Wealth Default Fund (0.37%)

- Simplicity Default Fund (0.31%)

- SuperLife Default Fund (0.20%)

- Westpac Default Balanced Fund (0.40%)

These funds launch on 1 December 2021 and any KiwiSaver member can choose to join these funds, even if you’re not with a default provider or fund.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

2. How do the changes impact you?

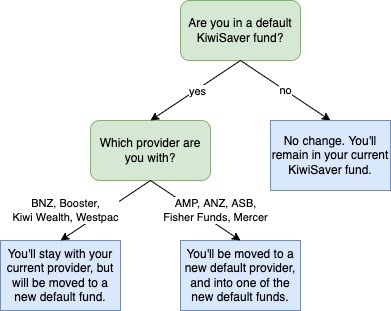

Over 356,000 or about one in nine KiwiSaver members are in default funds. From 1 December 2021, these investors will see a big change in where their KiwiSaver money is invested.

If you’re in a default fund with BNZ, Booster, Kiwi Wealth, or Westpac:

You’ll be automatically switched to your provider’s new default fund from 1 December 2021. This will result in your KiwiSaver money moving from a Conservative fund to a Balanced fund, where it’ll have a higher allocation towards growth assets like shares.

If you’re in a default fund with AMP, ANZ, ASB, Fisher Funds, or Mercer:

You’ll be automatically moved from your current provider to one of the six new default providers from 1 December 2021.This will also result in your KiwiSaver money moving from a Conservative fund to a Balanced fund.

If you’re not in a default fund:

This will be the case if you’ve actively chosen your KiwiSaver fund. On 1 December 2021, you’ll remain in your current fund.

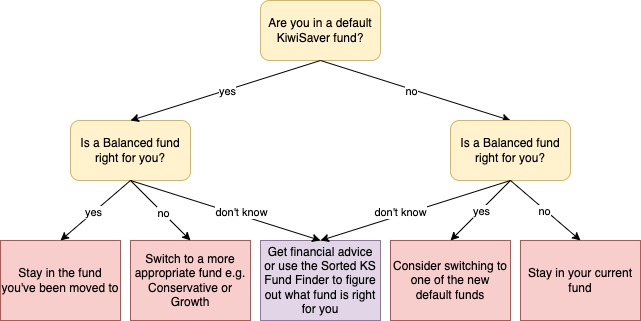

Do you need to take any action?

As part of these changes to KiwiSaver, it might be worth checking to see if you’re in the right type of fund.

If you’ve been moved to a new default fund:

And if a Balanced fund is right for you – Then you’ll already be in the right type of fund, and can simply stay in the fund you’ve been switched to! A Balanced fund should suit you if you’re investing for the medium term (for between 5 to 10 years), or if you’re risk adverse and want a fund with less ups and downs compared with a Growth fund.

And if a Balanced fund isn’t right for you – Then you may need to switch back to a Conservative type fund, or into a Growth fund. This will be the case if you’re a:

- Shorter-term investor – A Conservative fund may be more suitable for those investing for shorter timeframes (e.g. less than 5 years). These funds invest more of your money from cash and bonds, so protect your money from the volatility of the sharemarket.

- Longer-term investor – A Growth fund may be more suitable for those investing for longer timeframes (e.g. 10 years or more). These funds invest more of your money into shares (typically up to 80%), which makes the fund more volatile but should provide higher long-term growth.

Don’t know which type of fund suits you? Seek the advice of a professional adviser, or use the Sorted KiwiSaver Fund Finder to find out!

If you’re not in a default fund:

And you’re invested in a Balanced fund (or need to switch to a Balanced fund) – You may find these new default funds attractive alternatives to your current fund, especially with their fees being cheaper than their non-default counterparts. For example, SuperLife’s new default fund is one of the cheapest KiwiSaver options available with a fee of just 0.20%.

And you’re invested in another type of fund (e.g. Growth or Conservative) – These new default funds won’t have any implications for you, as there’s no changes to other types of funds.

3. Our favourite alternative funds

If you have the need to shop for a new KiwiSaver fund (perhaps because a Balanced fund doesn’t suit you), it can be hard to know where to start. So here’s on overview of our favourite funds.

This isn’t financial advice on what fund or provider to pick – just a selection of funds we think provide good features and/or good value for money.

Traditional funds

These providers offer traditional diversified funds which invest in a pre-made mix of cash, bonds, and shares, and typically come in Growth, Balanced, and Conservative varieties.

InvestNow Foundation Series

The InvestNow Foundation Series funds are excellent low-cost Growth and Balanced fund options, available as part of InvestNow’s KiwiSaver scheme. Their investment into NZ and international shares are passively managed, while their bond investments are actively managed, with management fees coming in at a competitive0.37% making them some of the cheapest funds available.

Simplicity

Outside of their new default fund, Simplicity are a popular low fee option offering Growth, Balanced, and Conservative funds. Fees are 0.31% per year. They market themselves as ethical, excluding investment into controversial industries, and donate part of their management fee to charity. While their funds are largely passively managed, they’ve branched out to invest in special initiatives including mortgage lending, private equity, and build-to-rent housing, which investors have had mixed feelings towards.

JUNO

JUNO offer actively managed Growth, Balanced, and Conservative funds. They don’t charge a percentage based management fee, but rather a fixed monthly fee based on your investment balance (starting from $2.50 per month), and are on the cheaper side for actively managed funds. JUNO has delivered solid returns so far, being the top performing Growth and Balanced funds over the 3 years to 30 September 2021, but they’re yet to prove themselves over the long-term.

Milford

Milford are another active fund manager, whose fees are a bit higher than the above providers (being up to 1.15%), but have delivered consistently strong returns over the long-term. They also offer an Aggressive fund which invests almost entirely into shares, which will be even more volatile than a Growth fund, but has potential to deliver higher long-term returns.

Further Reading:

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

– Simplicity vs JUNO vs BNZ – Battle of the low cost KiwiSaver funds

Pick your own funds

These providers offer the ability to pick from a variety of funds and assets to make up your own customised KiwiSaver investment.

InvestNow

InvestNow KiwiSaver provides the ability to invest your KiwiSaver money across 35 different funds from 14 different fund managers. This includes the above Foundation Series funds as well as funds from Milford, AMP, and Pathfinder. InvestNow doesn’t charge any fees, so the only fees you’ll pay are the management fees charged by the funds you pick.

SuperLife

Outside of their new default fund, SuperLife provides the ability to invest your KiwiSaver across 42 different options. These include diversified funds (investing in a mix of bonds and shares), and single sector funds (investing in a specific sector like NZ shares, US shares, or bonds). Fees are $30 per year + most funds charge a management fee of between 0.54% and 0.59%.

Craigs

Craigs KiwiSaver is the only scheme to allow investors to pick individual shares (out of a limited range of options) for their KiwiSaver. Altogether there’s over 200 companies, ETFs, and funds you can select from to build your own highly customised KiwiSaver portfolio. Fees are on the higher side with a $45 p.a. administration fee, management fees of up to 1.25%, and brokerage fees of up to 1.25%. However, it’s a premium service which includes access to research and an adviser who can provide guidance on what to invest in.

Kōura

Kōura‘s KiwiSaver scheme comprises six index funds which doesn’t provide as much flexibility as the above options, however they’re unique in employing a digital advice tool to help you pick what mix of funds best suits your personal circumstances. Kōura also regularly reviews and rebalances your mix of funds. Fees are $30 + 0.63% for all funds.

Further Reading:

– Build your own KiwiSaver – InvestNow vs SuperLife vs Craigs

How to switch KiwiSaver funds

Switching funds is quick and painless, so there’s no excuse not to switch if another KiwiSaver fund better suits you:

- Switching between funds with the same provider – Login to your provider’s online portal or contact them to request a change in funds. The exact process will depend on your provider, but generally the switch shouldn’t take longer than a few days to complete.

- Switching to a different provider – Sign up with the new provider you want to join, who will then take care of moving your KiwiSaver from your old provider for you. This process can take up to a few weeks to complete, and will usually be free unless your old provider charges exit fees. So all you need to do is be patient!

Conclusion

These changes to KiwiSaver default funds will result in a good outcome for investors. The 350,000 New Zealanders still invested in default funds will now have a larger proportion of their money invested in shares, and be in funds that provide better value for money, boosting long-term returns. But while the new funds are an improvement from the current situation, that doesn’t mean investors in default funds can sit back and relax. Balanced funds won’t be suitable for all investors, so it’s worth reviewing what type of fund works best for you and switch if necessary.

And if you’re in the majority of KiwiSaver investors not in a default fund, there aren’t many implications for you as part of these default provider changes. However, the new funds may be worth your consideration if you’re in the market for a Balanced fund. In the past default funds were intended to be a temporary parking spot for your KiwiSaver money (before you chose a fund), and most investors wouldn’t have actively chosen them. But they’ve now evolved to become viable, more permanent options with their low fees, and better investor engagement.

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.