Cryptocurrency has become an increasingly prevalent asset class, and while it has become easier for New Zealanders to buy Bitcoin since I wrote the article How to buy Bitcoin in New Zealand, the same can’t be said for selling Bitcoin. There are relatively few services which allow you to exchange Bitcoin or other cryptocurrencies back to New Zealand Dollars (popular exchanges like Binance and Crypto.com only allow you to buy with NZD, but not sell into NZD).

This article covers two ways you can sell your cryptocurrency – selling through an exchange/broker, or spending it. Even if you’re not planning to sell your crypto anytime soon, or if you haven’t invested yet, this article is still for you – as it’s important to consider how you might exit an investment well before you’re intending to do so.

Update (1 December 2021) – Include more comprehensive steps for using the Wirex card to change your crypto to NZD.

Option 1 – Sell your crypto through an exchange/broker

The first way to sell your Bitcoin (or other cryptocurrency) is to swap it directly for New Zealand Dollars. You can do this by sending your coins from your wallet or exchange (like Binance, Crypto.com, or Coinbase) to a broker such as Easy Crypto. Here’s a step-by-step guide:

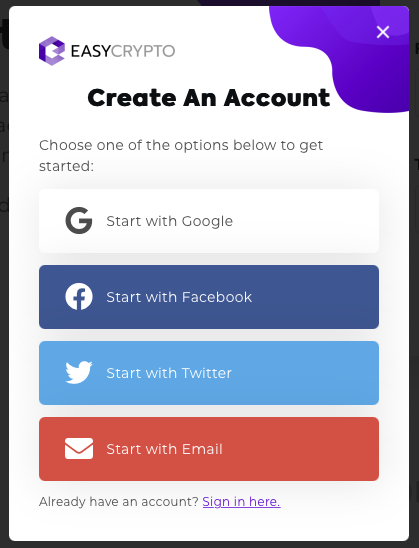

Step 1 – Sign up for Easy Crypto, and verify your identity using your ID.

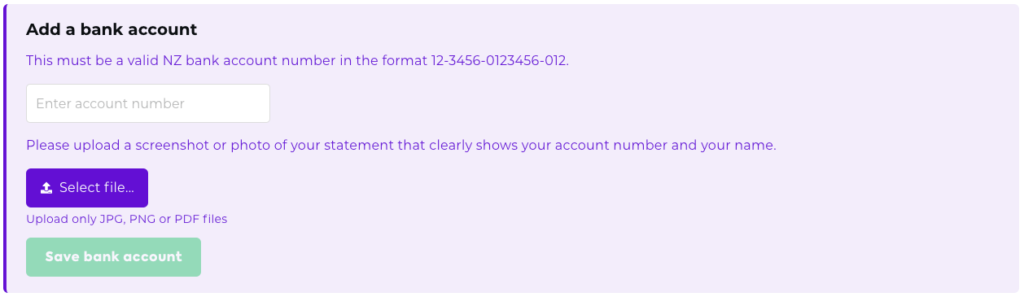

Step 2 – Add your bank account details to your Easy Crypto account on your Account Details page. This is where your NZD will be deposited once your crypto is sold.

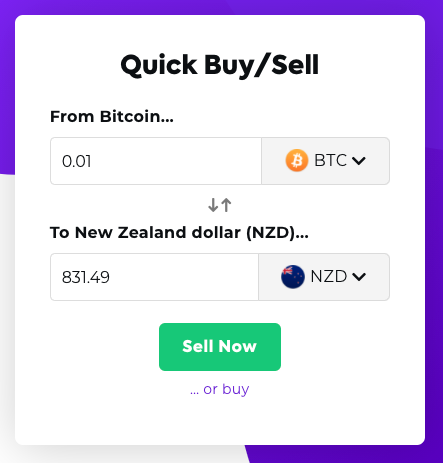

Step 3 – On the Easy Crypto homepage select the sell option, then type in the amount of Bitcoin or other cryptocurrency you want to sell. Then click Sell Now.

If you’re selling over $30,000 NZD of cryptocurrency in one transaction, you may have to provide proof of where you obtained the crypto from if you didn’t originally buy it from Easy Crypto.

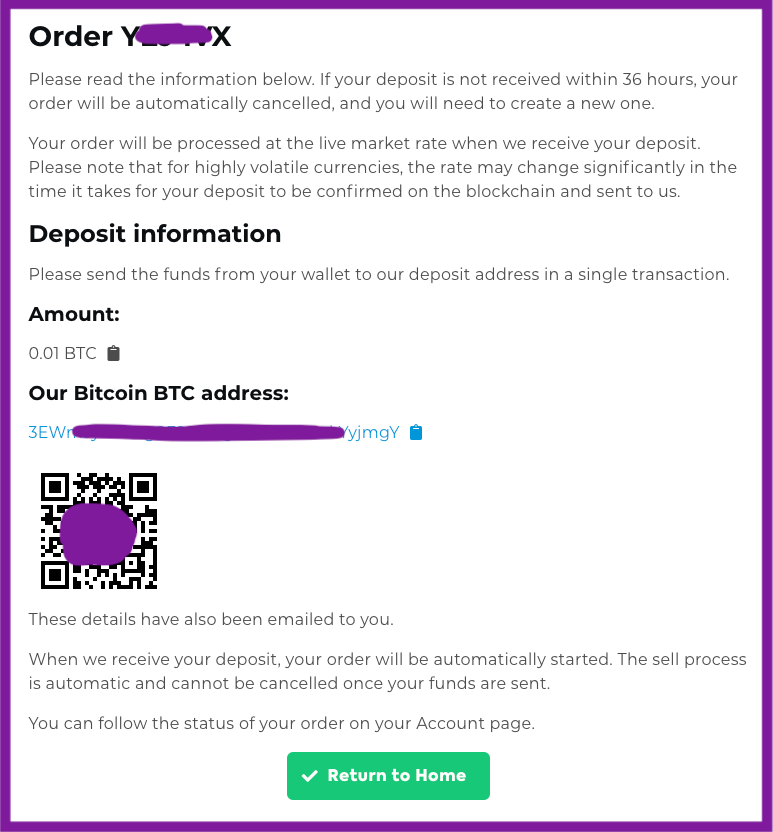

Step 5 – Follow the steps to generate a deposit address for your crypto.

Step 6 – Send/withdraw the exact amount of cryptocurrency you’re selling from your wallet/exchange to the deposit address. The instructions to do this will depend on where you’re sending your crypto from. Here are some examples of how to send/withdraw crypto using the mobile apps of popular services Exodus, Binance, and Crypto.com:

Withdrawing from Exodus – In your wallet click the send button, then enter the amount you are selling and the Easy Crypto deposit address you generated in step 5.

Withdrawing from Binance – Go to the wallet tab and click Withdraw. Select Crypto, then choose the cryptocurrency you wish to sell. Enter your Easy Crypto deposit address and the amount you’re selling.

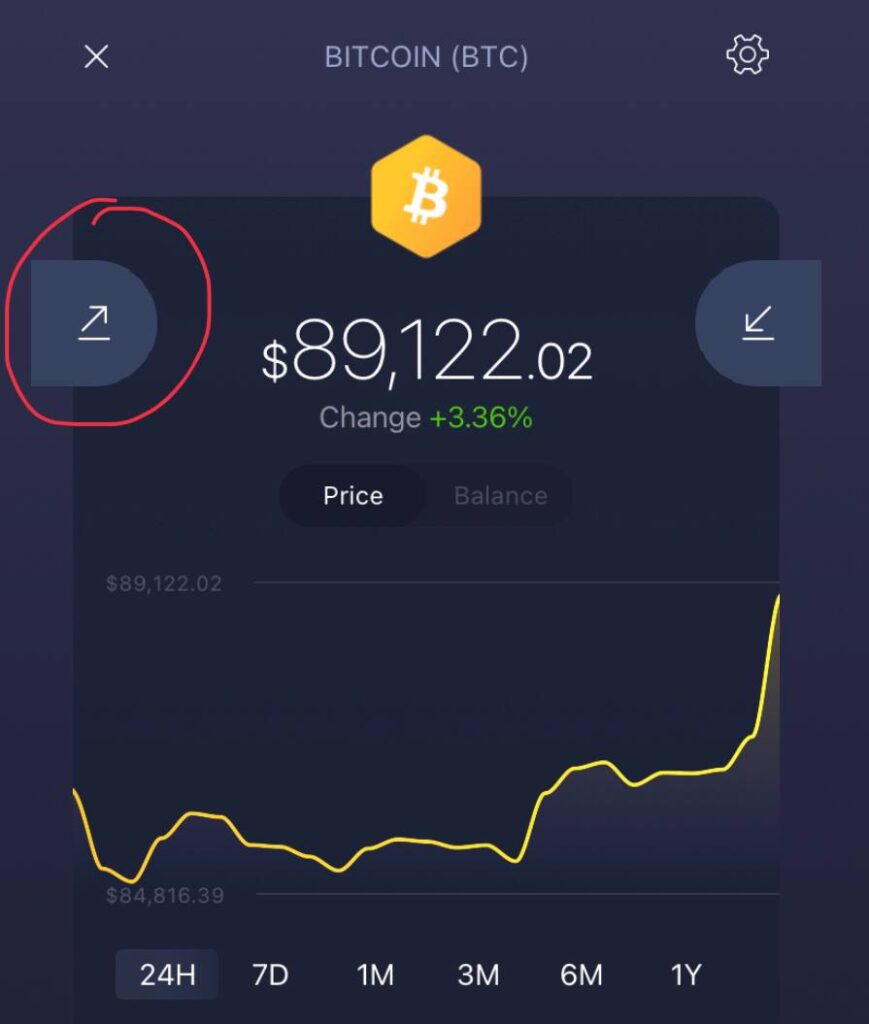

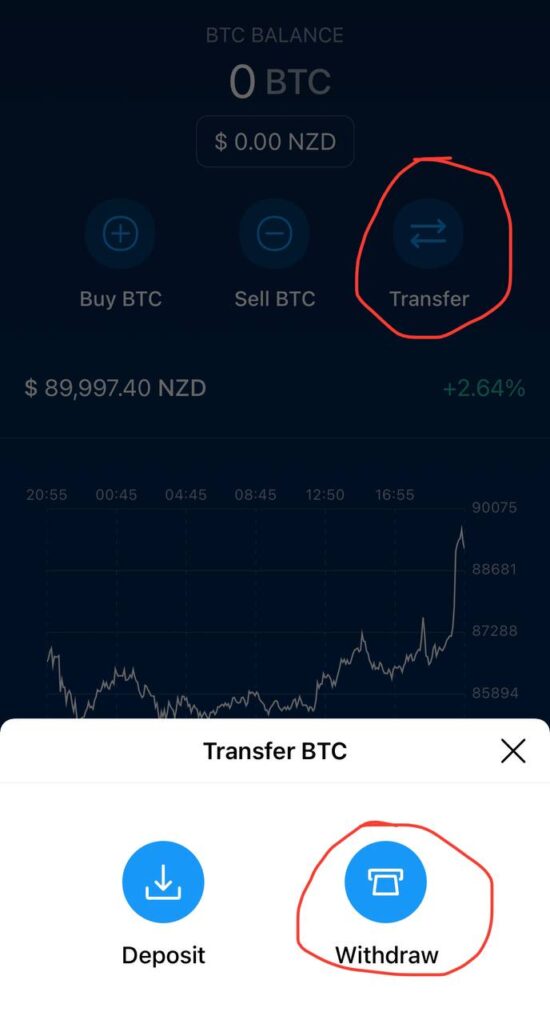

Withdrawing from Crypto.com – Go to the wallet of the crypto you’re selling, then click Transfer. Click Withdraw, then select the External Wallet option. Follow the instructions to add your Easy Crypto deposit address, then make a withdrawal to that address for the amount of crypto you’re selling.

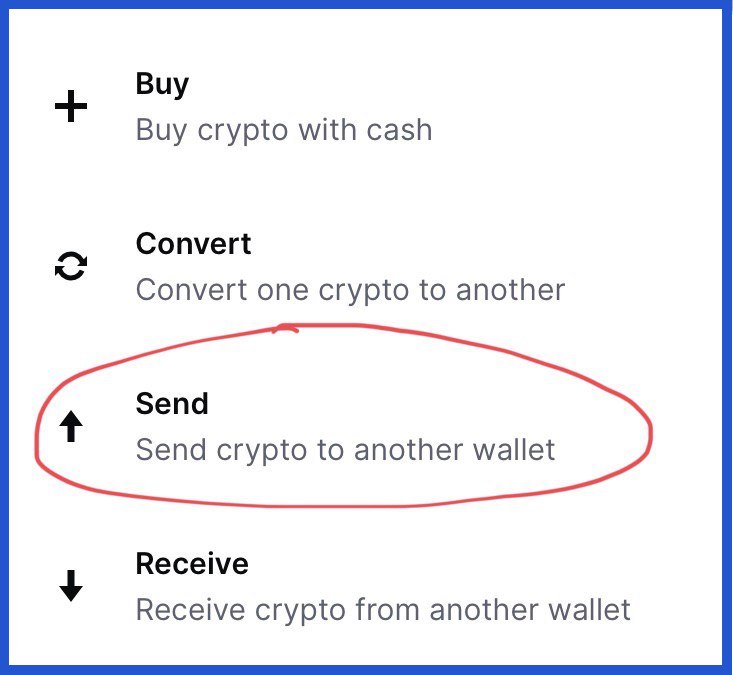

Withdrawing from Coinbase – Select the Send option to withdraw your crypto out to Easy Crypto.

Step 7 – Once Easy Crypto receives your cryptocurrency, they will exchange it for NZD and pay it out to your bank account. The exact amount of NZD you get will depend on the exchange rate at the time Easy Crypto receives your deposit. Your money could take some time to arrive in your bank account as NZD transfers depend on bank processing times (banks don’t send transactions on weekends or public holidays).

Tip 1

While the list of cryptocurrencies you’re able to sell though Easy Crypto is extensive, for more obscure cryptocurrencies you may first have to exchange that cryptocurrency into a major crypto such as BTC or LTC before selling it via Easy Crypto.

Tip 2

When sending cryptocurrencies you must pay a network fee, and this will affect the amount of crypto you can sell. For example, if you wanted to sell 1 BTC from Crypto.com you would need at least 1.0004 BTC (1 BTC to send to Easy Crypto and 0.0004 BTC to cover the network fee). Network fees vary from time to time and from crypto to crypto, but most wallets/services will automatically calculate the required network fee for you.

Tip 3

Some cryptocurrencies (e.g. Ethereum and ERC-20 tokens) can have very high network fees at times due to network congestion. If you’re holding your ETH on an exchange like Binance or Crypto.com, consider swapping it for a cheaper crypto like Litecoin or Binance Coin prior to selling it via Easy Crypto.

Alternative services

- Kiwi-Coin – A New Zealand Bitcoin exchange which can potentially be more cost effective, but less streamlined than Easy Crypto. After depositing Bitcoin to Kiwi-Coin, you must place an order into the order book and match with a buyer, and then manually withdraw the NZD into your bank account (which incurs a $10 fee).

- Peer to Peer trading – You can trade Bitcoin for NZD directly with another individual without going through an exchange/broker. There are Facebook groups or services like LocalBitcoins available to help facilitate P2P transactions. This option can be very cost effective, however won’t be for everyone as you have to trust the other party, and there is usually limited support if something goes wrong.

Option 2 – Spend your crypto

To sell your coins, you don’t have to swap it directly for New Zealand Dollars. You can also spend it – after all it is a form of currency. Unfortunately, retailers and institutions who accept cryptocurrency payments are still few and far between. However, some crypto companies have developed solutions to help people spend crypto in more places.

One of these solutions is crypto debit cards such the Wirex Visa card, which offers a convenient way to spend your crypto online, in-store, or withdrawn through an ATM.

Below are the steps for applying for the Wirex card:

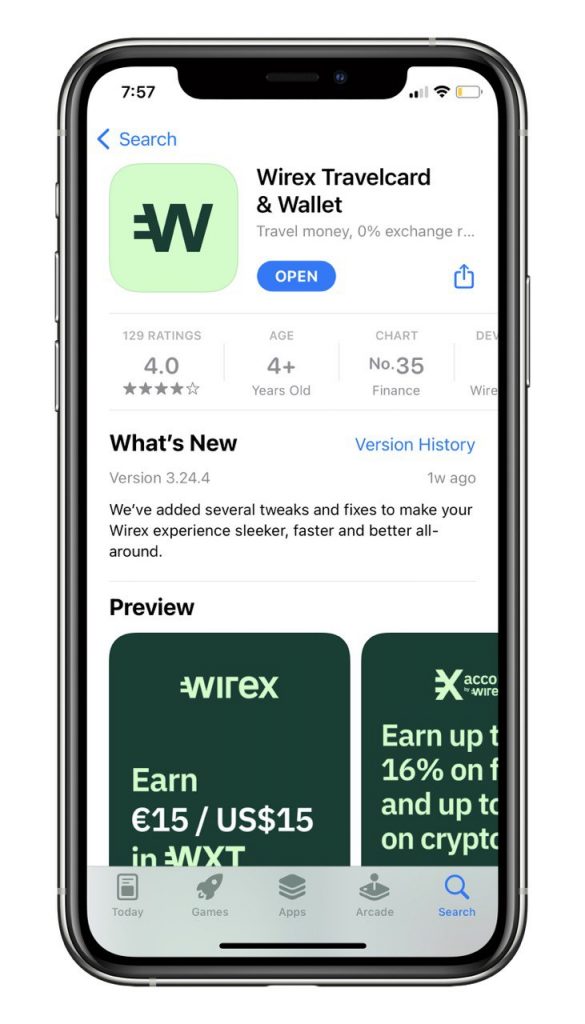

Step 1 – Sign up for Wirex and verify your identity. This can be done through the Wirex mobile app which can be downloaded from the Apple App Store or Google Play Store.

Step 2 – To apply for the card you must:

- Deposit at least $20 into your Wirex account. This can be done by linking your bank debit/credit card to your Wirex account

- Pay $9.99 SGD for shipping

Step 3 – Wait for your card to be delivered. This should take about 1 week from the time you applied for the card.

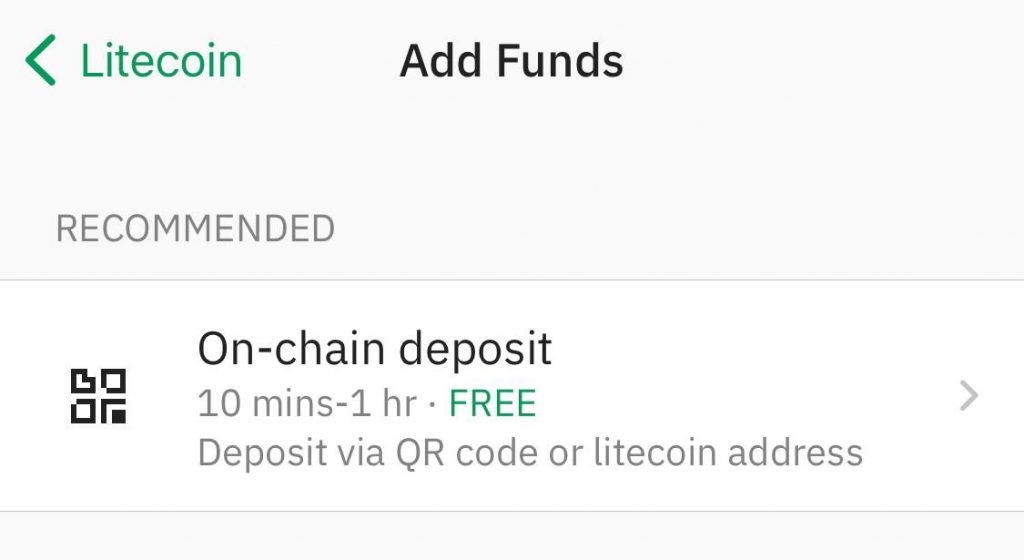

Step 4 – Wirex accepts a few cryptocurrencies like BTC, ETH, LTC, DAI, LINK, MKR, NANO, XLM, and XRP. This can be done by going to the account of the crypto you wish to deposit, clicking Add Funds, then selecting On-chain deposit to generate an address for you to send your coins into.

Step 5 – Deposit crypto into your Wirex account by making a withdrawal from your wallet/exchange into the deposit address generated above in step 4.

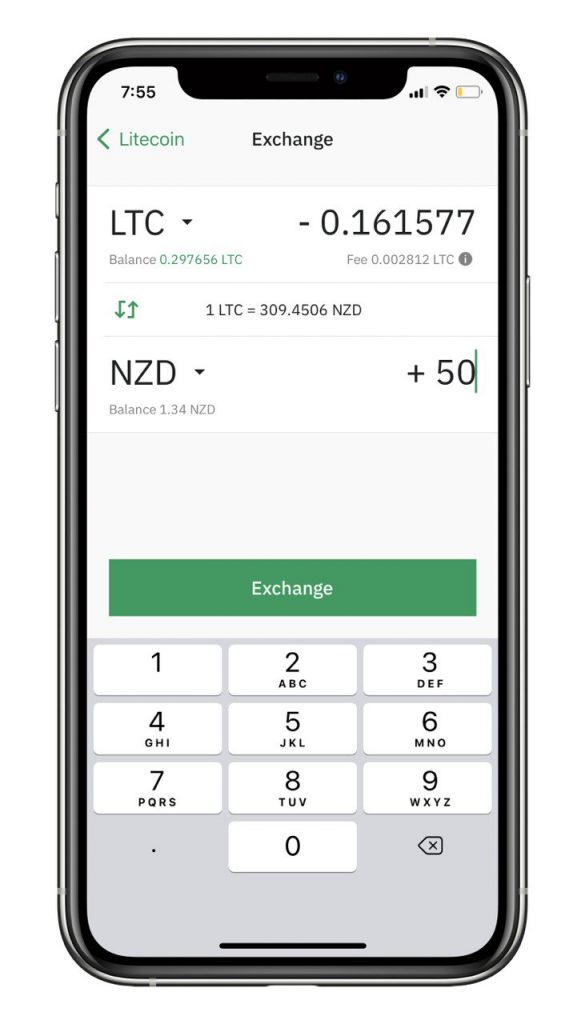

Step 6 – It can take some time for the crypto to arrive in your Wirex account. Once it arrives, exchange the crypto to NZD (which costs a couple percent in exchange fees).

Step 6 – Now you should have NZD in your Wirex account, which you can now spend in-store, online, or withdraw cash from an ATM (Wirex allows $400 SGD worth of free ATM withdrawals per month).

Alternative services

- Crypto.com – An incredibly popular crypto debit card which rewards you with Crypto.com coins (CRO) as cashback on every purchase. The downsides for Kiwi users are:

- You must buy and stake at least $500 SGD of Crypto.com coins (CRO) to apply for the card. This locks up your CRO coins for 6 months.

- You must have your address verified before your card is issued. There is a substantial wait time for this to happen, and even more wait time before your card is issued and shipped.

- The card doesn’t support NZD. Instead you must convert your crypto to SGD before spending it through the card.

- The card has a 6-digit PIN which means the card won’t work at some retailers, though anywhere with PayWave should work fine.

Tax

Lastly, remember you may be liable for tax when you sell or spend your Bitcoin. Generally any capital gains you make on your crypto is considered taxable income, unless you can prove to the IRD that you didn’t buy the crypto for the purpose of selling or exchanging them (for a profit). This income can be declared on your IR3 Individual Tax Return at the end of the tax year. Services such as Taxoshi may help in calculating the tax you’re liable for on your cryptocurrencies.

Further Reading:

– Cryptoassets – IRD

– What taxes do you need to pay on your investments in New Zealand?

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.