Sharesies, Hatch, and Stake are relative newcomers to the New Zealand investment industry, providing cheap and convenient access for Kiwis to invest in shares listed in the United States of America – a market much greater in size, and with a lot more choice compared with our domestic market, including some of the largest and most famous companies in the world.

If you’re looking for a platform to buy and sell US shares, then this article is for you! Read on to see a comparison between Sharesies, Hatch, and Stake including how they work, the fees they charge, and other things you may want to consider.

This article covers:

1. What’s on offer?

2. Investment process and the associated fees

3. Fee comparison

4. Other considerations

Update (30 Oct 2021) – Hatch now offers the ability to participate in IPOs

Update (12 Oct 2022) – Sharesies has added auto-invest for US shares

1. What’s on offer?

The platforms

Sharesies – A Wellington based investment platform which also offers investment into NZX (New Zealand) and ASX (Australia) listed shares. They started offering US shares in mid-2020, and are NZ’s largest investment platform by number of users, with over 400,000 members.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Hatch – Another Wellington based platform, who are owned by Kiwi Wealth (part of the Kiwibank group). They launched in September 2018, and currently only offer US shares.

Stake – First launched in Australia in 2016. They expanded into New Zealand in May 2020 and currently only offer US shares.

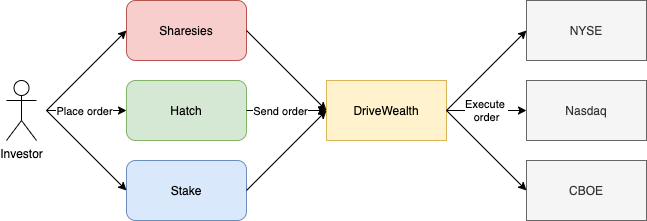

The executing broker

Sharesies, Hatch, and Stake all partner with the same executing broker:

DriveWealth – Sharesies, Hatch, and Stake do not execute any orders on the US market. Instead, they take orders from their investors, then send the orders to DriveWealth (a US based broker) who executes the orders on behalf of the platforms.

What you can invest in

Because all three platforms partner with the same executing broker, the investments on offer are quite similar. They all offer fractional investment into shares and ETFs listed on the following US exchanges (unlike the NZ market, the US has multiple major exchanges):

- New York Stock Exchange (NYSE)

- Nasdaq

- Chicago Board Options Exchange (CBOE)

Not all shares and ETFs listed on these exchanges are available through these platforms, as DriveWealth doesn’t offer all of them (mainly smaller sized companies and ETFs are missing). But the choices that investors have is still plentiful with over 3,000 assets on offer including:

- Individual companies e.g. Apple (AAPL), Nike (NKE), and Tesla (TSLA).

- Exchange Traded Funds (ETFs). These are funds that contain a wide range of assets e.g. the Vanguard 500 Index Fund ETF (VOO) which invests the 500 largest companies listed in the US, and the SPDR Gold Trust (GLD) which invests in gold.

- American Depository Receipts (ADRs). These are receipts/certificates that represent shares of companies listed outside of the US e.g. Alibaba (BABA), and Nio (NIO).

What is fractional investment?

Traditionally investors would have to buy whole shares of a company. For example, with 1 share in Amazon currently priced at about $3,300 USD, you would have to put in a minimum of $3,300 to invest in the company. Fractional investment gives you the option to buy or sell parts of a share. For example, if you only had $100 USD you could still buy 0.03 Amazon shares – much more accessible!

2. Investment process and the associated fees

Let’s have a look at the process of investing in US shares, from getting money into the platform, buying shares, to finally selling them, and withdrawing the money back intto your own bank account.

Step 1 – Depositing money

The first thing to do after signing up to Sharesies, Hatch, or Stake is to deposit New Zealand Dollars into your account. The platforms offer different ways of depositing money, and each may have associated fees.

Sharesies

- Bank deposit – Deposits take a few hours to arrive in your account during bank processing times (i.e. on business days). Deposits are not processed over the weekend or public holidays. No fees.

- Credit card – Credit card deposits instantly arrive in your account. There is a credit card processing fee of 2.65% + $0.18 NZD, and a further fee of 2.65% of the credit card processing fee. For example, if you deposited $100, the credit card processing fee would be $2.83, and the additional fee would be $0.07 – for a total fee of $2.90. This is confusing and very expensive so credit card deposits should be avoided!

Hatch

- Bank deposit – Deposits take a few hours to arrive in your account during bank processing times. No fees.

- USD deposit – You can make a USD deposit into Hatch from a USD bank account in your name. You can also deposit USD from a service like Wise, but this money can’t be withdrawn from your account for 30 days.

Stake

- POLi – There is a 4pm cut-off time for the deposit to arrive at about 1pm New York time. No fees.

- POLi express funding – There is a 10pm cut-off time for the deposit to arrive at about 9am New York time. There is a fee of 0.50% of your deposit, with a minimum charge of $2.

- Bank deposit – Beta functionality which works the same way as Sharesies and Hatch bank deposits.

Step 2 – Currency exchange to USD

To buy shares in the US, you have to change your NZ Dollars to US Dollars. How this happens depends on the platform:

- Sharesies – The NZD in your Sharesies wallet can be manually exchanged to USD at any time, otherwise it is automatically exchanged to USD at the time you purchase US shares.

- Hatch – Any deposits you make are automatically exchanged to USD at the time the deposit is received (unless you directly deposited USD, in which case you can skip this step).

- Stake – Any deposits you make are automatically exchanged to USD at the time the deposit is received.

All three platforms charge a foreign exchange fee for swapping your money from one currency to another:

- Sharesies – 0.40%

- Hatch – 0.50%

- Stake – 1.00%, with a minimum fee of $2 USD

Step 3 – Before your first investment

Before you make your first purchase of US shares, you have to do some US tax paperwork by completing a W-8BEN form so that you’ll end up paying the right taxes. All platforms file this form for you, although may charge you a one-time fee for doing so:

- Sharesies – No fee

- Hatch – $1.50 USD, deducted from your account balance when you make your very first deposit

- Stake – $5 USD, deducted from your account balance when you make your very first deposit

Step 4 – Buying shares

Once you have your USD and tax paperwork sorted, you can now buy some US shares! Your platform may charge you a brokerage fee:

- Sharesies – 0.5% of your purchase, then 0.1% of your purchase for amounts over $3,000

- Hatch – A flat $3 USD for purchases of up to 300 shares, then an additional 1c per share over 300 shares

- Stake – No brokerage fee

Step 5 – Holding shares

Once you’ve bought some shares, they are held safely on your behalf by a custodian. There are typically no fees for holding shares on these platforms, but you should be aware of the following:

- Hatch charges an annual $0.50 USD fee for tax filing

- If you invest in ETFs, these all have management fees. These fees aren’t charged by your platform, nor are they deducted from your account balance. They are charged by the fund manager of your ETF and are reflected in the ETF’s unit price.

- If you invest in ADRs, depository fees are payable. These fees very between different ADR offerings but are typically an annual fee of a few cents per share. These fees aren’t charged by your platform, but rather are charged by the depository bank offering the ADR.

Step 6 – Selling shares

When it’s time to sell your shares, you’ll pay another set of brokerage fees as you did when buying the shares:

- Sharesies – 0.5% of your sale, then 0.1% of your sale for amounts over $3,000

- Hatch – A flat $3 USD for selling of up to 300 shares, then an additional 1c per share over 300 shares

- Stake – No brokerage fee

There is also a very small regulatory fee that must be paid when you sell US shares:

- Sharesies – Does not pass this fee on to investors

- Hatch – Does not pass this fee on to investors

- Stake – SEC fee of $0.051 per US$10,000 of sale proceeds + TAF fee of $0.000119 per share with a per-transaction cap of $5.95.

Step 7 – Currency exchange to NZD

After selling your US shares, you’ll be left with USD in your account. This can’t be withdrawn to your bank account until you exchange it to NZD. For this you’ll pay another set of foreign exchange fees:

- Sharesies – 0.40%

- Hatch – 0.50%

- Stake – 1.00%, with a minimum fee of $2 USD

Step 8 – Withdrawing your money

Withdrawing the NZD to your bank account should take a maximum of 3-4 days. Only Stake charges a fee for withdrawing your money of $2 USD.

3. Fee comparison

There is no clear winner when it comes to which platform is cost effective. The cheapest for you will depend on a few factors such as how often you buy or sell US shares and the size of your buy/sell transactions. Let’s run through some scenarios to see how their fees roughly work out on each platform, for the entire lifetime of an investment (all figures below are in USD):

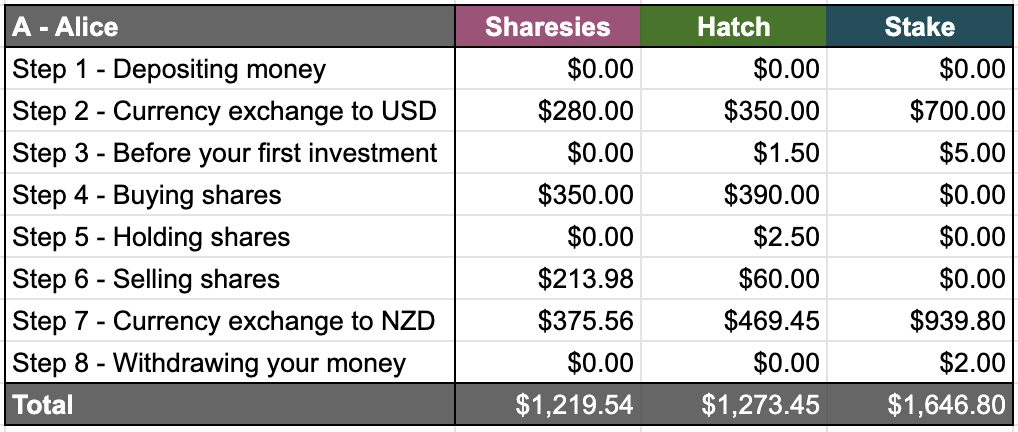

A. Alice from Auckland

Alice starts by investing $10,000 USD evenly split between 10 US companies. She adds $1,000 per month to her portfolio, split between 2 of her companies. She sells everything 5 years later, having made a return of 10% per year. Alice’s fees are:

Sharesies and Hatch are cheapest for Alice (with Sharesies winning by about $50), given her transaction sizes are at a point where the two platforms have similar fees. Stake is much more expensive, given their FX fees are significantly higher.

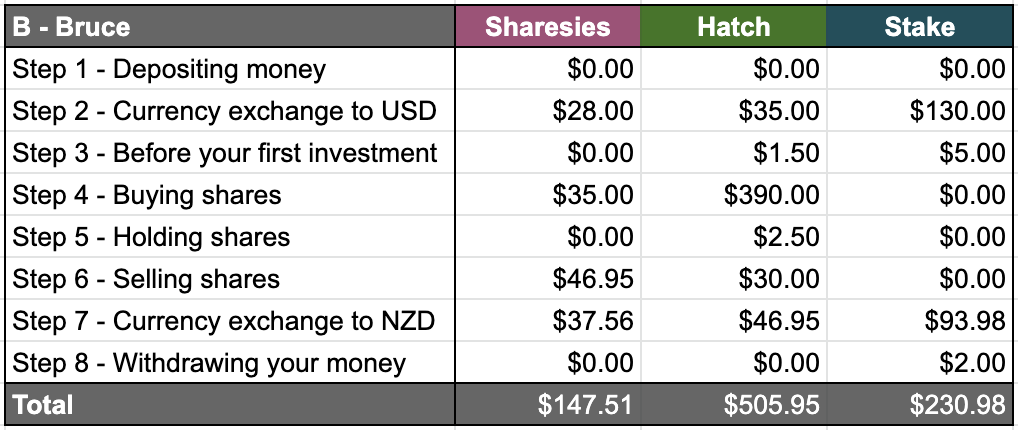

B. Bruce from Blenheim

Bruce starts by investing $1,000 USD evenly split between 10 US companies. He adds $100 per month to his portfolio, split between 2 of his companies. He sells everything 5 years later, having made a return of 10% per year. Bruce’s fees are:

Bruce’s fees are cheapest on Sharesies given his small investment amounts. Stake is slightly more expensive thanks to their higher FX fees (the $2 USD minimum fee for FX doesn’t help), while Hatch is significantly more expensive as the flat $3 brokerage fee is high relative to his small contributions.

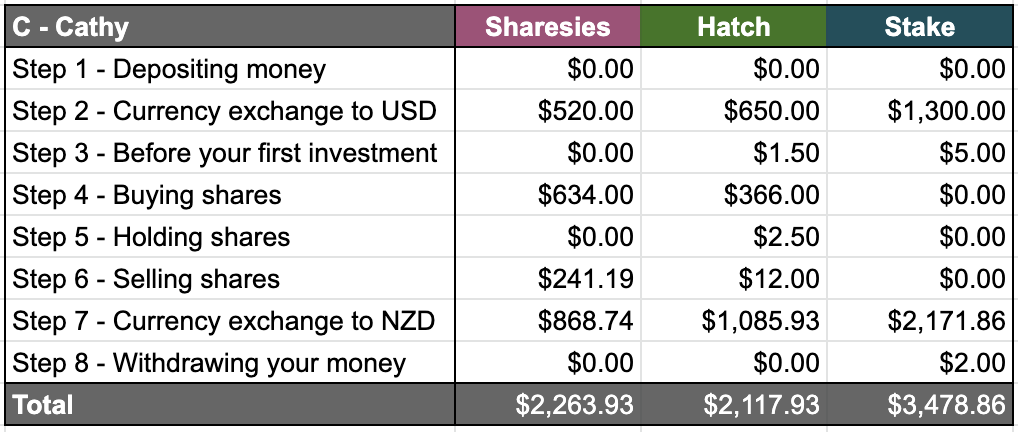

C. Cathy from Christchurch

Cathy starts by investing $10,000 USD evenly split between 2 US ETFs. She adds $1,000 per month to her portfolio, into one of her ETFs. She sells everything 10 years later, having made a return of 10% per year – a long-term investor! Cathy’s fees are:

Hatch is the cheapest for Cathy, given she is making fairly large transactions. An interesting point to note is that Hatch’s brokerage fee is incredibly low for selling off Cathy’s shares (I’m assuming she has 600 units in each ETF). This is because Hatch’s brokerage fee stays fixed, while Sharesies’ brokerage fee grows along with your investment value. Therefore Hatch would be even cheaper if Cathy’s investment had increased in value more.

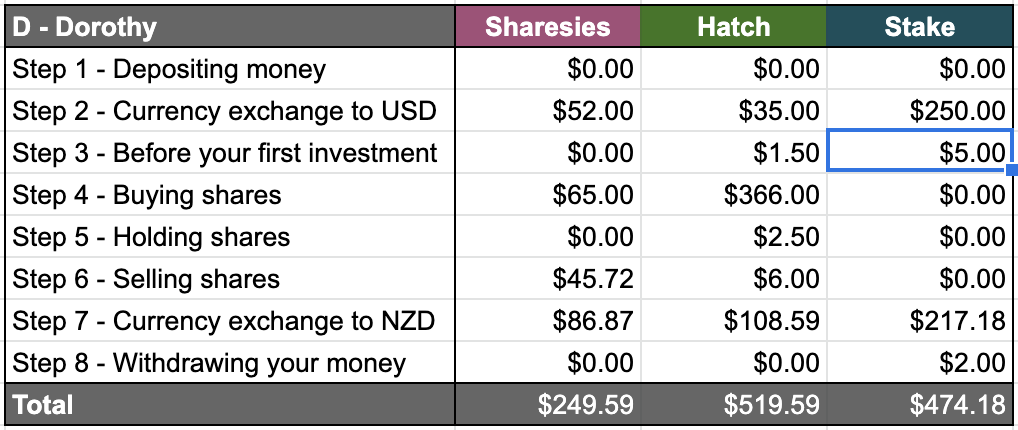

D. Dorothy from Dunedin

Dorothy starts by investing $1,000 USD evenly split between 2 US ETFs. She adds $100 per month to her portfolio, into one of her ETFs. She sells everything 10 years later, having made a return of 10% per year. Dorothy’s fees are:

Like Bruce, Dorothy’s fees are cheapest on Sharesies given her small investment amounts.

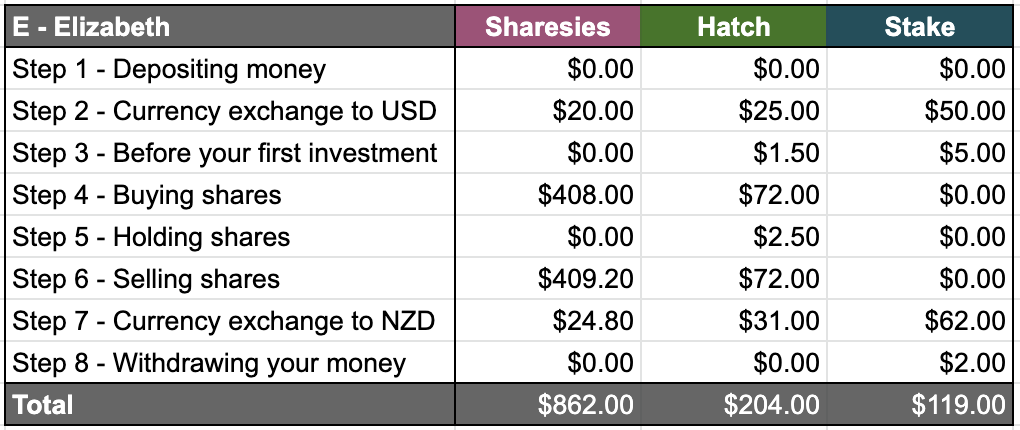

E. Elizabeth from Edgecumbe

Elizabeth deposits $5,000 USD into her brokerage account. She uses this capital to make 2 trades per month (for a total of 4 transactions a month – 2 buys, and 2 sells), making 1% on each trade. 1 year later she withdraws her capital and profits. Elizabeth’s fees are:

Given she is trading in and out of shares, Elizabeth’s fees are cheapest on Stake as they do not charge brokerage fees. Hatch is next cheapest, as the size of her transactions are cost efficient relative to Hatch’s $3 USD brokerage fee.

So very broadly speaking:

- Sharesies and Hatch are best for buy and hold investors. Sharesies is cheaper for making smaller transactions as their fees are percentage based, so do not penalise low investment amounts. Hatch is cheaper for larger transactions (becoming cheaper than Sharesies for transactions over ~$750 USD), as their flat fee penalises small investment amounts, but works well for larger investments – you could buy $1 million USD in Amazon shares for just $3 brokerage!

- Stake has high foreign exchange fees, but are best if you intend to trade in and out of shares because they have no brokerage fees. Just ensure you don’t withdraw your money in between trades to avoid incurring the FX fee.

4. Other considerations

Kids accounts

- Sharesies – Offers kids accounts, but do not offer any special kids rates.

- Hatch -The only platform that provides special rates for kids accounts (under 18s). Brokerage is discounted to $0.50 USD for transactions of up to 50 shares, then 1c for every additional share. This makes Hatch cheaper than Sharesies if investing over ~$125 USD at a time, but this investment size won’t be affordable for many kids.

- Stake – Requires their members to be 18 or over. Sorry kids.

Further Reading:

– How to invest for kids in New Zealand

Voting

Shareholders in companies are typically entitled to voting rights. This allows you to elect company board members, and vote on important company issues like mergers and acquisitions:

- Sharesies – No voting rights for US shares.

- Hatch – You get voting rights on full shares only. For example, if you own 1.5 shares in a company, you get the voting rights of 1 share.

- Stake – Voting rights on both full and fractional shares.

Tax

The tax liability on your US assets is the same regardless of the platform you use. Your US assets are considered to be Foreign Investment Funds and FIF tax rules apply. This rule requires you to choose from one of two methods to calculate your taxable income on each FIF investment you own:

- Fair Dividend Rate (FDR)

- Cumulative Value (CV)

Use this IRD calculator to calculate your taxable FIF income under these two methods. Once you have calculated your taxable income, you will need to pay tax on that income at your marginal tax rate.

But if you have invested less than $50,000 in FIF investments, you’re a de minimis investor and can elect to apply the de minimis exemption, and simply pay tax on the dividends from your FIF investments (rather than following the above FIF tax rules). You still apply the above FIF rules if you want (particularly if they work out in your favour), but if you do so, you must use them for the next four years.

Neither Hatch or Stake handle your tax obligations for you, but they provide annual reporting to help you complete your tax returns at the end of the year

With Sharesies, assuming you live in NZ and are a NZ tax resident, tax is automatically deducted from your dividends at a rate of 33%. While that’s all your tax obligations conveniently sorted for you if you’ve invested less than $50,000 NZD in overseas assets, there may be a couple of problems with this automatic approach:

- If you’re a de minimis investor, it assumes you want to apply the de minimis exemption and pay tax at a rate of 33%. There is no option to use the FIF tax rules even though they may be favourable to you (especially if you earn dividends at a rate of over 5%, or make a capital loss for the year). Nor can you elect to have tax deducted at a lower/higher tax rate.

- If you have invested over $50,000 in overseas assets, you’ll end up having tax deducted from your dividends when they shouldn’t be (as your tax is based on the FDR or CV calculation, rather than dividends).

Further Reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

Transfers

If you want to break up with your current sharebroker, platforms may allow you to transfer your US shares in or out:

- Sharesies – Does not allow transferring US shares in or out. If you wanted to switch from Sharesies to Hatch for example, you’d have to sell your US shares, exchange the money to NZD, withdraw the NZD to your bank account, deposit the NZD to Hatch, exchange the money back to USD, then buy back into your shares!

- Hatch, Stake – Allows transferring US shares in or out. While transfers between Hatch and Stake are free (given they use the same executing broker, DriveWealth), transfers to/from other brokers may incur a fee.

Trading restrictions

While the platfoms allow you to buy and sell US shares freely, there may be some restrictions on how you trade:

- Trading on unsettled funds – When you sell shares, the transaction does not settle until two trading days after the trade takes place. Trading on unsettled funds is good for selling out of one asset to invest into another asset, as it allows you to immediately buy shares with the proceeds of a sale, before the settlement date. For example, I can sell Apple shares for cash on Monday, then immediately use that cash to buy Amazon shares without waiting for that cash to settle on Wednesday.

- Day trading – The ability to buy, then sell the same asset within the same day.

Here are the restrictions enforced by each platform:

- Sharesies – No restrictions on trading

- Hatch – Allows you to trade on unsettled funds, but if you sell the shares you bought using unsettled funds within two trading days, you’ll trigger a Good Faith Violation. If you make three Good Faith Violations in 12 months, you won’t be able to trade on unsettled funds for 90 days. Otherwise Hatch has no other restrictions on trading.

- Stake – Does not allow you to trade on unsettled funds, unless you pay $9 USD per month for a “Stake Black” membership (this also gives you other features like analyst ratings). Stake also has restrictions on day trading, marking you as a Pattern Day Trader if you make more than three day trades within five trading days. Pattern Day Traders aren’t able to make another day trade for 90 days.

Extra features

Auto invest – Sharesies and Hatch have auto-invest functionality which can be set up to automatically place orders to buy selected shares or ETFs on a regular basis:

- Sharesies: weekly, fortnightly, every four weeks, or monthly.

- Hatch: Weekly, fortnightly, every four weeks, monthly, or quarterly.

Initial Public Offerings (IPOs) – Hatch gives investors the ability to participate in IPOs. This occurs when a company newly lists on the sharemarket, and offers their shares to the public for the first time. Participating in an IPO means you can buy shares in a company just before it starts trading on the sharemarket.

Interest on cash holdings – Hatch automatically invests your cash holdings into a money market fund, so that you can earn some interest on your uninvested money.

Stop orders – Hatch and Stake offer stop-loss and stop-buy orders. You can set up stop-loss orders to automatically sell your shares if they drop to or below a certain price. Stop-buy orders work the opposite way – they can be set up to automatically buy shares if they increase to or above a certain price.

Other markets – Sharesies also offer investment in NZX and ASX listed shares. This may be a compelling reason for you to choose Sharesies for US shares, if you wish to hold all your entire share portfolio through one platform.

Conclusion

Sharesies, Hatch, and Stake are all great services for investing in US shares. Their ease of use and fee structure certainly beats previously available options such as ASB Securities which charged brokerage fees of at least $90!

Sharesies is best for those investing small amounts at a time, although they have fewer features like the ability to transfer shares in or out. Their tax treatment on your US investments can make things easy (as your tax liability may automatically be taken care of for you), but could disadvantage some investors. Lastly, having your NZX and ASX investments on the same platform could be convenient.

Hatch is perhaps the most professional platform, offering the most features like auto-invest, stop orders, and voting. But you’d want to make investments of at least a few hundred dollars at a time to make the brokerage fee worthwhile compared to Sharesies and Stake. This isn’t necessarily a bad thing as it could encourage you to carefully research an investment opportunity before committing money to it, as opposed to Sharesies and Stake which can encourage taking small punts on random shares or ETFs.

Stake’s key feature is having no brokerage fees. Instead they make money on charging higher foreign exchange fees. This will be worth it if you are trading in and out of US shares and ETFs somewhat regularly, but not so much if you’re a long-term buy and hold investor. However, trading is not an easy way to make money from investing, results in having to pay tax on your capital gains, and Stake’s trading restrictions prevent you from day trading too frequently.

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.