“KiwiSaver is a good investment for kids.” “Simplicity is the best KiwiSaver provider!” “KiwiSaver is a scam!” In our third myths and misconceptions article we’ll be busting some of the usually well-intentioned pieces of information surrounding KiwiSaver, that we don’t think are correct.

Our myths and misconceptions articles:

– 12 common investing myths and misconceptions busted

– 12 more investing myths and misconceptions busted

– 12 KiwiSaver myths and misconceptions busted (this article)

– 12 tax myths and misconceptions busted

1. KiwiSaver is a good investment for kids

We’ll start the article with the somewhat controversial opinion that we don’t think KiwiSaver is a good investment for kids. That’s because any money you contribute to the scheme is generally locked up until your child buys a house or until they reach the age of 65. By contributing to their KiwiSaver, you’ve made the decision your child will go down one of these paths – but your child may never want to buy a house, or they may aspire to retire at an earlier age. In addition, kids typically get no benefits in return for the trouble of locking up of their money in KiwiSaver. Under 18s don’t qualify for Government contributions, nor are their employers obligated to make Employer contributions.

What’s the alternative?

Investing in KiwiSaver for your kids is better than not investing at all. KiwiSaver funds are accessible with no minimum investment, are hands-off, can offer long-term growth potential, and it’s relatively easy to navigate the different fund options. So while many are big proponents of KiwiSaver for kids, we think it’s better to invest for kids using non-KiwiSaver investment products.

There’s plenty of non-KiwiSaver investment options to choose from such as Kernel, InvestNow, and SuperLife. These all allow you to invest in funds identical to their KiwiSaver counterparts with similar fees, and offer the same benefits of long-term investing such as compounding returns and the opportunity to educate your child on sound financial habits. And all of this comes with the flexibility of being able to withdraw the money at any time for things like education, starting a business, or travel.

Further Reading:

– How to invest for kids in New Zealand

2. KiwiSaver is a scam. It’s controlled by the government and they can take your money

Many people believe that KiwiSaver is a government scam, where they can take your money or use the scheme to capture more tax. Here’s some social media comments showing a not too uncommon attitude towards the scheme:

A socialist con job and I hope one day you will understand what I mean

You know they use KiwiSaver to offset debt to GDP?

Fuckn scam John Key’s scam. Can never buy a house. An be half dead if yr lucky u maybe able to withdraw scam to keep yr money dead or alive

But this isn’t true, unless you were to call investing as a whole a scam. KiwiSaver isn’t a government-run savings account, but rather the money you put into the scheme is managed by an independent fund manager, who invests it into assets like shares and bonds with the aim of producing a return. It can’t be used by the government to build new schools or pay for politicians’ salaries. Nor can they capture more tax with the scheme. Your KiwiSaver is invested and taxed the same way as if you were to invest outside of KiwiSaver.

Alternatively we see people saying that KiwiSaver investments perform poorly, so it’s not worth investing in the scheme. Some even believe that when their balance goes down, it’s because the government is taking away their money! Here’s some more social media comments:

Stuff KiwiSaver, all it does is lose money. Better investing in gold

Mine is decreasing rapidly. Don’t do it people, save your money elsewhere.

My recommendation is don’t join KiwiSaver. I did years ago, it’s a bad investment program

Interesting because my lawyer told me, the Grubberment has stolen everyone’s KiwiSaver and Super!

The perception that KiwiSaver funds have poor returns is also untrue. Investing in a KiwiSaver fund is no different to investing your money into an investment fund outside KiwiSaver – You’ll get the same potential returns and market volatility either way. And as with all investments, just because your KiwiSaver performed poorly over the short-term, doesn’t mean it’s a bad long-term investment.

The difference between KiwiSaver and non-KiwiSaver investments really just boils down to when you can withdraw the money – which for KiwiSaver is generally restricted to when you buy a first home or reach the age of 65. The government could always change the rules around KiwiSaver (defined in the KiwiSaver Act 2006) but it would be unlikely for any change that adversely affected the scheme to be politically popular. So we believe there’s very few genuine excuses not to invest in the scheme and take advantage of the incentives like employer and government contributions.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

3. Conservative funds are a safe option

Conservative funds are often seen as the safe option for investors – an option that offers lower potential returns, but provides the safety of lower volatility. However, Conservative funds invest heavily in bonds (and usually also contain a small allocation to shares). And just like shares, bonds can have bad years and go down too – though usually not as frequently and severely as the former.

We’ve seen that in 2022 where due to the awful performance of the bond market, some Conservative funds have been hit just as hard as their Growth counterparts, leaving investors shocked. For example, Simplicity’s Conservative Fund fell 4.9% in the 3 months to 31 March 2022, not far off from the average Growth fund drop of 5.7% over the same period.

Other providers have fared slightly better during this time, with the average Conservative fund holding up better than Balanced/Growth/Aggressive funds:

| Fund type | Average 3 months return to 31 March 2022 |

| Conservative | -3.9% |

| Balanced | -5.1% |

| Growth | -5.7% |

| Aggressive | -6.5% |

So Conservative funds are still a relatively safe option, just not as “safe” as some may have imagined. They can still suffer from market downturns, and that’s why they tend to have recommended minimum investment timeframes of 3 years, to give you time to recover from such downturns. Those wanting to avoid volatility altogether and preserve their capital would need to use a Cash fund, turning your KiwiSaver into a pseudo savings account. But this won’t be in your benefit if you’re investing medium to long term, as you’ll miss out on the higher growth/income potential of investing in bonds and shares.

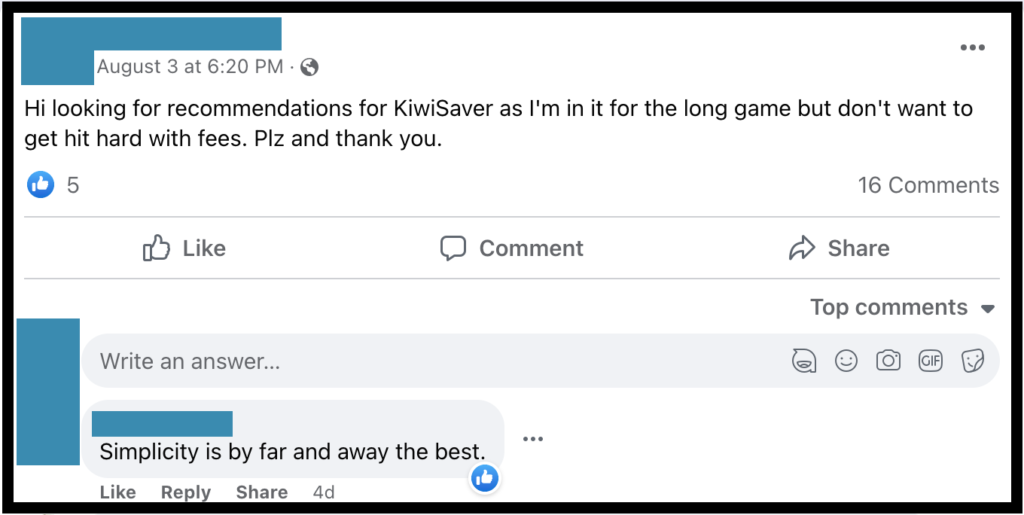

4. Simplicity is the best KiwiSaver provider

Ask an online investment community for KiwiSaver provider recommendations, and usually the most common response you’ll get is Simplicity.

They have a lot of great features such as ethical exclusions, donations to charity, and most importantly their fees are low. They’re one of the better providers (one of our top 5 favourites) and are deservedly one of the most recognisable KiwiSaver brands out there. But we certainly wouldn’t call them the best. For example, there’s a number of issues with their offering:

- No cash fund – Simplicity don’t offer a fund that invests purely in cash to help protect your money from market volatility when you need to withdraw it in 1-2 years time. Quite odd considering they’re a scheme that targets home buyers with their mortgage offering.

- No aggressive fund – Simplicity also don’t offer an Aggressive fund (investing almost entirely into shares) for those investing for the very long-term and who are willing to take on more volatility. The closest they have is the Growth Fund which only has a 78% allocation to shares, so will likely underperform an Aggressive fund over the long-term.

- Tax leakage issues – Their funds are structured in a way that makes them tax inefficient, adding at least a 0.15% negative tax impact to Growth Fund investors. More details on tax leakage in the article below.

- Side investments – Instead of being a pure index tracking investment, Simplicity’s funds also invest in mortgage lending, build-to-rent housing, and private equity. Some are fans of these side investments, others see them as vanity projects.

Fortunately Simplicity isn’t the only low fee KiwiSaver option out there. Low-cost alternatives include Kernel, InvestNow, and BNZ‘s schemes. However, we wouldn’t go as far as calling any of these the best KiwiSaver providers either – all providers have flaws, for example:

- Kernel – They don’t yet have any conservative or balanced offerings, and their global shares fund offering arguably isn’t as diversified as competing funds.

- InvestNow – Their Foundation Series offering doesn’t include a conservative option, nor do they have ethical exclusions.

- BNZ – They’re relatively expensive for a low-cost offering, and also don’t offer an aggressive option.

And most importantly, what’s best for you may differ from what’s best for someone else, and will depend on things like your investment goals and personal preferences. There’s really no such thing as a “best” KiwiSaver scheme.

Further Reading:

– What’s the best low cost Growth/Aggressive KiwiSaver fund?

5. You should max out your KiwiSaver contributions as they’re tax free

Unfortunately this isn’t correct – there’s no tax advantages to making KiwiSaver contributions. While your contributions are calculated as a percentage of your pre-tax income, they still end up being subjected to your usual PAYE tax. There’s no advantage to contributing more than the minimum 3% unless:

- You need to contribute more in order to max out your government contribution.

- Your employer offers higher contributions if you increase your own contribution rate.

- You intentionally want your money to be locked up, so you aren’t tempted to spend it.

So if none of these reasons apply, consider investing any extra money outside of KiwiSaver instead of increasing your contribution rate. You’ll have more flexibility and access to more investment options this way.

6. The markets are down so I should decrease my contributions or switch to a Conservative fund

It’s been an awful year so far for the financial markets, with pretty much every asset class and market falling substantially. There are two somewhat common reactions of KiwiSaver members to this market downturn:

Reduce contributions

I’ve lost 1g in my KiwiSaver. Given up hope. waste of time “contributing” when it just goes down

Stopped contributing because it’s going down and we cant access it

When the markets are down, some may be tempted to reduce their contributions or take a Savings Suspension, to avoid tossing more money into what they see as a loss making venture. Every person’s situation is different, and you may have genuine reasons to reduce your contributions, such as no longer being able to afford them. However, generally you shouldn’t tweak your contributions in response to market conditions.

The markets going down doesn’t mean your contributions are going into a black hole, nor is it an indication that the markets will continue to go down. In fact they’re a great time to keep up your contributions as you’ll be buying into your fund at cheaper prices, so each Dollar you contribute goes further in buying up units of your fund. Downturns won’t last forever, and accumulating more units means you’ll benefit in the long-term as your fund recovers and grows.

Switch to a more conservative fund

Those in Growth or Aggressive funds may be looking to switch to a more conservative fund to protect themselves from further losses. But this move comes with two major issues:

- You’ll lock in your current losses – By switching to a more conservative fund you’ll be selling shares (which have dropped significantly) to buy bonds/cash (which typically haven’t fallen as much), so you’ll be realising the losses you’ve made on your shares.

- You’ll minimise your potential gains – By sheltering in a more conservative fund, you’ll minimise your potential losses, but you’ll also minimise your potential gains when the markets inevitably bounce back. Essentially you can’t have the gains without taking on the risk.

You might argue that you could simply switch back to a Growth fund as soon as the markets recover. But how will you know when the markets are starting to do so? The market rebound isn’t announced in advance, and by the time you realise the market has turned, you’ve probably already missed out on much of the gains.

As always, everyone’s situation is different and perhaps you have a genuine need to switch to a more conservative fund – for example, if it better suited your risk tolerance or investment timeframe. But in general, if your goals and personal circumstances haven’t changed, then nor should your KiwiSaver strategy.

7. My fund is down. I’ll wait for it to bounce back before I switch to a new fund

With over 30 KiwiSaver providers offering hundreds of fund options, being able to switch between funds and providers is an important feature of the scheme, to ensure you’re investing somewhere that aligns with your needs and preferences. But many people are worried about switching from one fund to another, because their current fund is down due to the market downturn. That’s because we’re all familiar with the concept that “you’ll lock in your losses if you sell”, which leaves many to wait until their fund recovers before they switch.

Locking in losses doesn’t apply here

However, the concept locking in losses doesn’t apply here, as long as you’re switching between similar types of funds. Take Growth funds for example which invest mostly into shares, so are all similarly affected by the current market downturn. In the quarter ending 31 March 2022, apart from a couple of outliers all Growth funds returned close to the same average return of -5.7%.

So while you’ll be exiting one Growth fund at a loss, you’ll be entering your new Growth fund at a similarly lower price. Another example is moving house during a housing market downturn. In this case you may have to sell your existing house at a loss, but you’d be able to find a new house at cheaper prices than before. Overall, anytime is a good time to switch between similar funds, as long as your new fund better suits your goals or investing preferences.

8. You need to contribute at least $1,042.86 each year to get the government contribution

$1,042.86 is the magic number in employee or voluntary contributions you need to make each year to get the maximum $521.43 in government contributions. However, there’s no minimum amount you need to contribute to qualify for government contributions.

You’ll still get $0.50 in government contributions for every $1 you make in employee or voluntary contributions, even if you contribute less than $1,042.86. For example, if all you contribute during the year is $100, you’ll still earn a government contribution of $50. So don’t worry if you can’t afford to contribute $1,042.86. It’s still worth contributing as much as you’re able to, as the government contribution is essentially a risk free 50% return on the money you put in.

Other government contribution rules

Here’s a few other government contribution rules that people often miss:

- Those aged under 18 or 65+ don’t qualify for government contributions.

- Those living overseas won’t qualify either.

- If you joined KiwiSaver or turned 18 partway through the year (running between July and 30 June each year), you won’t be eligible for the full government contribution. It’ll be pro-rated to the number of days you’ve been an eligible member.

- You need to get your contributions in by 30 June each year, in order to qualify for the current year’s government contribution. But don’t leave things until the last minute, as many providers need a week or two to process your contributions. Though even if your contributions miss the cut-off date, they’ll still count towards getting next year’s government contribution.

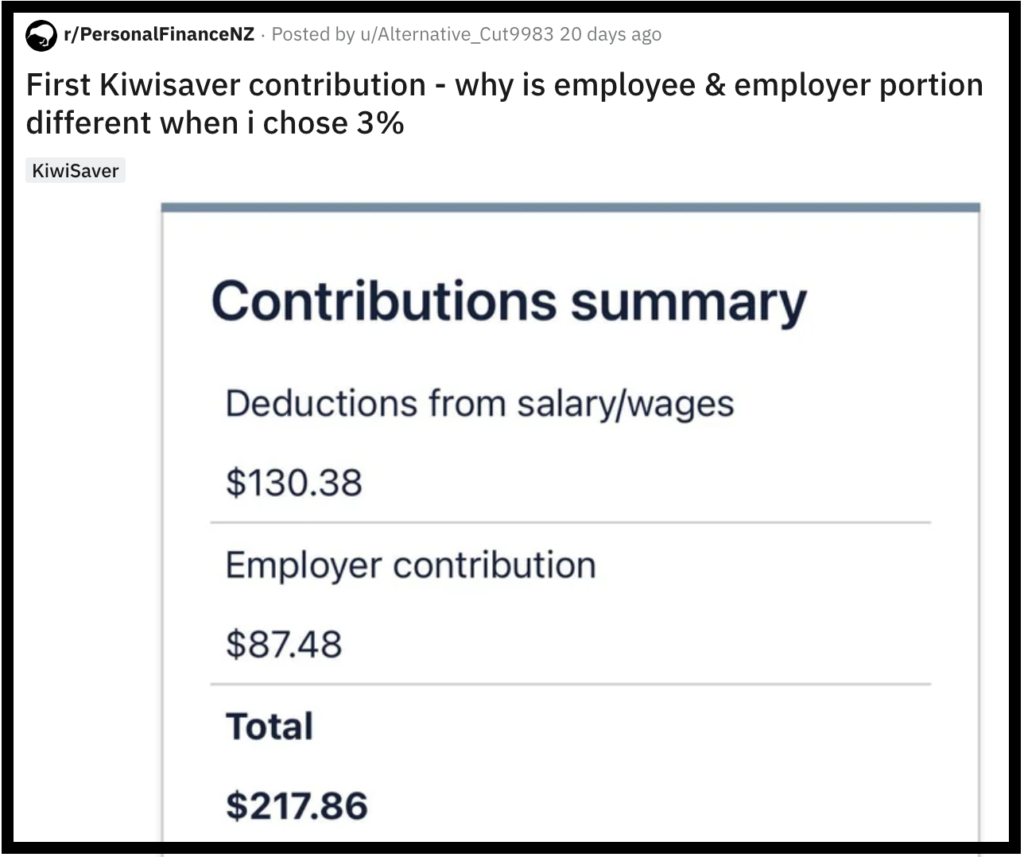

9. My employer matches my KiwiSaver contributions

If you’re an employee, your employer has to match your contributions at a rate of 3%. The exceptions to this are some employers who match and contribute at a higher rate, and others who pay total remuneration packages in which case employer contributions are deducted from your own salary.

However, even if you and your employer have matching contribution rates, the actual dollar amount you’ll receive from employer contributions will differ from your employee contributions. See below as an example:

That’s because employer contributions have tax applied to them in the form of Employer Superannuation Contribution Tax (ESCT). This tax applies because employer contributions are income that haven’t been taxed yet – they’re paid to you on top of your usual salary/wages and aren’t captured by your usual PAYE tax. ESCT is applied at the following rates, depending on your income:

| Your annual income | ESCT rate |

| $0 to $16,800 | 10.5% |

| $16,801 to $57,600 | 17.5% |

| $57,601 to $84,000 | 30% |

| $84,001 to $216,000 | 33% |

| $216,001+ | 39% |

10. I should choose a different KiwiSaver from my partner, to diversify across providers

There’s few reasons why two partners may choose to invest in different KiwiSaver providers from each other. However, we think it’s unnecessary to diversify for these reasons:

- In case a fund manager goes bust – Some partners may decide to diversify across providers in case one of them goes bust. But this isn’t necessary as all your funds are held by a custodian who keeps your money safe and segregated from your provider if they were to go out of business – in which case your money would likely be transferred to another provider. Providers also have independent supervisors who ensure they act in the interests of investors and in accordance with the regulations.

- In case a fund manager performs poorly – Some partners may choose to use two different KiwiSaver providers in case one performs badly. But the benefit you can achieve from this is limited. For example, during a sharemarket downturn all Growth funds will have their performance impacted, and (apart from a couple of outliers) all Growth funds will drop by a similar amount. There’s no way to diversify your KiwiSaver holdings away from market movements, as no single provider is immune from them.

- To be more diversified in general – You may argue that holding a different fund to your partner increases your overall diversification. But KiwiSaver funds are already diversified by nature, usually holding hundreds and possibly thousands of assets. For example, Milford’s Active Growth Fund contains over 700 holdings spread across NZ and international shares, NZ and international bonds, and cash. That already provides more than enough diversification, making investing into a different fund unnecessary.

So there’s no harm in picking the same provider and fund as your partner if both of you like it. But in the end it comes down to your personal preferences. There’s nothing wrong with investing across different providers either, but it’s better to do so for the right reasons.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

11. It’s better to pick a KiwiSaver based on higher overall returns, rather than lower fees

Given the choice between the following two funds, which would you pick?

- Fund A – 0.35% fee, 8.5% p.a. return

- Fund B – 1.20% fee, 11% p.a. return

You would’ve been better off picking Fund B, as even after paying their significantly higher fees, you’d have come out on top with their superior returns. However, choosing a fund based purely on high returns is a very poor strategy. Firstly, returns don’t take into account the risks you need to take on to get there. The higher returns of Fund B look great, but you may have had to take on more volatility than you were able to stomach to get to that return.

But most importantly, returns are backwards looking so a high return doesn’t mean you’ll continue getting that return year after year. Very few fund managers sustain their place at the top of the performance charts over the long-term. Take Juno’s Growth Fund for example which blew the competition away when they first launched, but slumped to a very distant last place in the past year (while also increasing fees in the process). Or consider the case of Lara who got burnt after investing in funds purely based on their past performance. There’s just no way to tell which funds will perform the best into the future.

| 1yr to 31 Mar 2020 | 1yr to 31 Mar 2021 | 1yr to 31 Mar 2022 | |

| Juno Growth | 9.7% | 45.6% | -14.2% |

| Average | -3.2% | 29.4% | 2.8% |

On the other hand low fees are great, but fees alone don’t say anything about the quality of the fund, or its suitability to you. Take Simplicity for example, who have attractive fees but offer an arguably lower quality fund with their tax leakage issues, or in many cases aren’t suitable to investors due to their lack of cash and aggressive funds.

So what’s important when choosing a fund?

Despite returns and fees both being flawed metrics to look at when choosing funds, we still prefer to put a heavy emphasis on fees. That’s because:

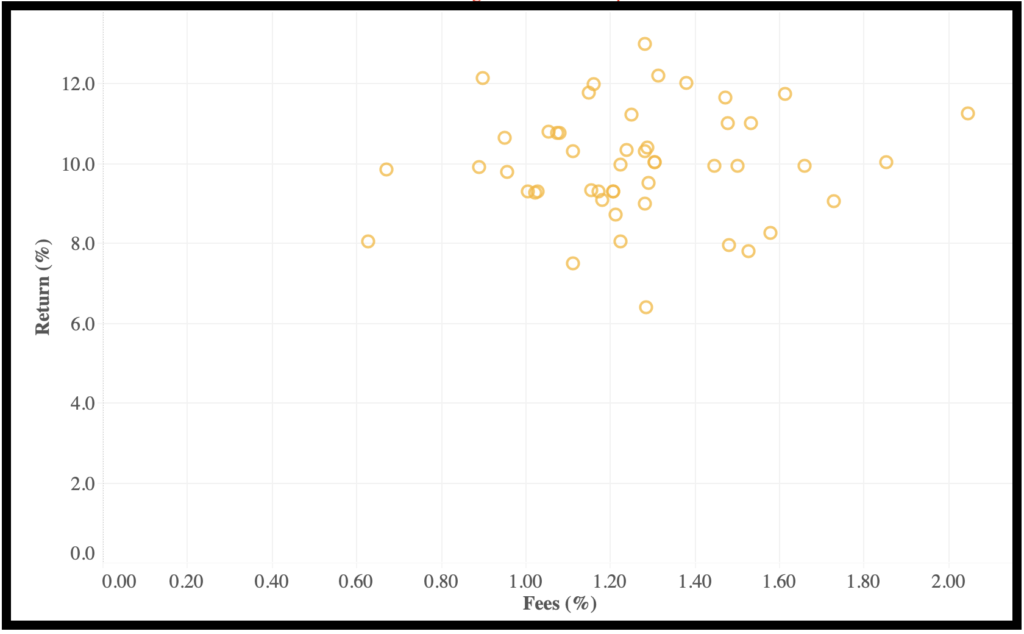

- High fees doesn’t = high performance – Data shows there’s no clear relationship between fees and performance, so you might as well lean towards paying less in fees.

- The fees we pay are in our control – In investing it’s better to focus on things that are within your control (such as the fees you pay), as opposed to things you can’t control (like performance which is solely in the hands of your fund manager and the financial markets).

But overall, we believe that value for money is really what matters when selecting a KiwiSaver fund. It may be one of the most important assets you own, and the cheapest option may not necessarily be the best for you. So it could be worth paying a bit more in fees if you feel a particular fund better aligns with your goals or ethics, provides better service, or if you’re a fan of a particular fund manager.

Further Reading:

– The ultimate guide to KiwiSaver funds and schemes

12. I don’t need to invest for my retirement. My home and government super will be enough

NZ Superannuation is a universal government pension, with almost everyone in NZ aged 65+ qualifying for the payments, whether you’re rich or poor. It’s a fairly generous scheme, with fortnightly payments of between $712 and $926 (depending on your living situation), which go a long way towards meeting your living costs in retirement.

The after-tax NZ Super rate for couples (who both qualify) is based on 66% of the ‘average ordinary time wage’ after tax. For single people, the after-tax NZ superannuation rate is around 40% of that average wage.

Sorted.org

Homeowners will also take comfort in owning a property in their golden years. However, there’s a risk in thinking that NZ Super and owning a home will be enough to fund your retirement:

- NZ Super isn’t guaranteed – Most of our readers are aged between 25 and 45, so chances are you have 20-40 years to go before you’re eligible for NZ Super. That’s plenty of time for rules to change in terms of who’s eligible for the payments. With NZ Super being the government’s biggest expense, and with an ageing population, we’re not counting on it to be available to us by the time we retire.

- Will Super be enough for your lifestyle? – While Super payments go a long way, they won’t be enough to cover the lifestyles of many people. It’s estimated a couple will need an extra $153 per week on top of Super payments just to live a basic “no-frills” lifestyle in one of the main centres, and an extra $758 per week to live a “choices” lifestyle. That’s money that’ll have to come from savings or working beyond 65.

- You can’t eat your house – Owning a house is not that useful when it comes to funding your retirement. Your own home typically doesn’t generate income, and you can’t use it to buy food, pay for utilities, or to travel the world. You’d need to release equity through downsizing or taking out a reverse mortgage in order to pay for your retirement expenses.

So we wouldn’t bank on the government and owning a home to live a financially secure retirement. It’s really up to you to take charge and build the retirement that you want. A good place to start is to use the calculators on Sorted to work out how much money you might need to fund for retirement, then use tools like KiwiSaver to help you get there.

Conclusion

With around 3.1 million members, KiwiSaver is by far New Zealand’s most prevalent investment scheme. It’s sure to attract a bunch of myths and misconceptions, and a wide range of different views. So are there any myths and misconceptions we missed? Or any points in the article you disagree with? Let us know in the comments below!

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.